Unicorn stocks, like the unicorns of myth, are incredibly rare. Simply put, they’re companies that are wildly profitable yet insanely undervalued. So their share prices have nowhere to go but up.

These are the stocks that fortunes are built on. They are the Microsofts and Apples that people today kick themselves for not buying back in the ’80s. A more recent example is Rolls-Royce, which made many of my own readers a lot of money when it rocketed from $2 per share to $10. That’s a 400% increase. Some readers even got in at $1 or lower and took home a 1,000% gain.

Unicorns create life-changing money. Every $10,000 invested in Rolls-Royce would have become $50,000 within a couple of years. Stocks like it are also vanishingly rare in today’s overvalued stock market.

They are incredibly profitable… yet almost nobody is talking about them.

At any given time, you could likely count the number of unicorns in the market on one hand. As of right now, only one stock, out of all the 23,281 publicly traded stocks, qualifies as a unicorn in the making.

But unlike most unicorns, this one has a friend in the highest place imaginable…

Star-Spangled Profits…

“America First!” is right up there with “Make America Great Again” for President Donald Trump’s most well-known campaign slogans.

And it’s a slogan that Trump seems committed to making a guiding principle of his second term.

He has been in office only a short time. But he is already aggressively defending the United States’ national interests and, by extension, the interests of this country’s businesses as well.

American businesses are some of the most dominant companies in the world. They’re a big part of why the U.S. has prospered and grown into the global superpower it is today. They have achieved that in spite of governments around the world doing their best to hamstring them through heavy taxation and overregulation.

The previous administration at best simply allowed that to happen. At worst, it compounded the issue through high taxes and innumerable regulations at home. But not Trump. And he has gone to bat for the unicorn in this report against the United Kingdom…

It’s called APA Corporation (Nasdaq: APA). And despite being one of America’s premier oil and gas companies, it trades for about the price of a halfway-decent lunch.

The company’s basic business is simple – it works like any other oil and gas producer. APA has operations in the United States, Egypt, and the United Kingdom, as well as exploratory activities off the coast of Suriname.

It’s the way APA is going about its business, and the friends and partners it has in its corner, that gives it such an incredible edge and transforms this all-around solid company into a unicorn.

But first, the England situation…

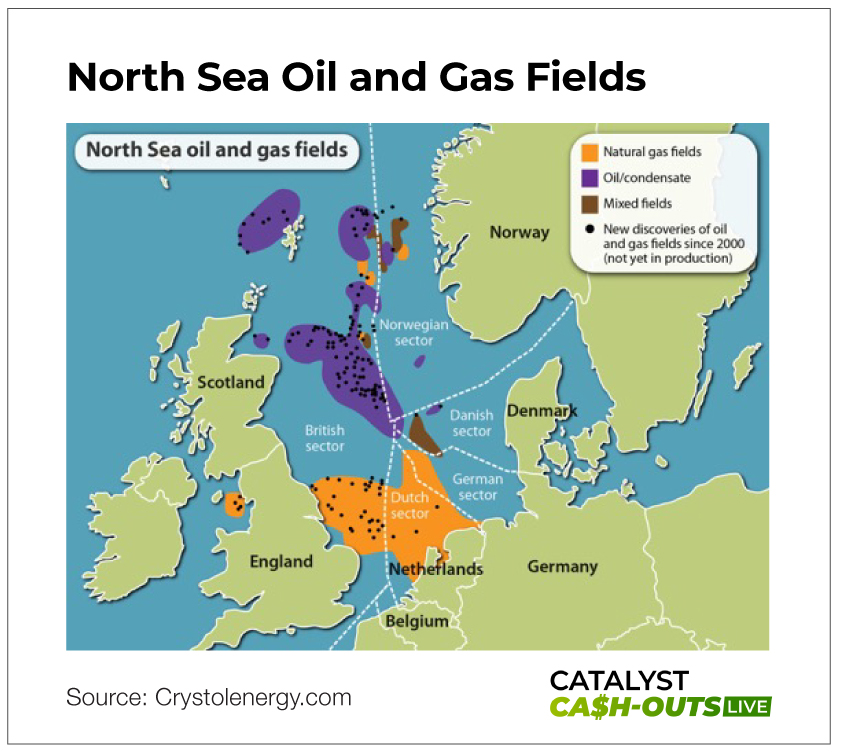

The United Kingdom has some of the world’s richest oil and gas reserves in the world just offshore in the North Sea. But Britain seems to hate cheap energy. The Labour government under Keir Starmer announced a tax increase of 3% on North Sea oil extractors.

British oil and gas companies such as Harbour Energy and Shell had to take that lying down. But not APA. Not with Trump in office. He unloaded on Britain, telling the prime minister he was making a “big mistake.”

And that’s true. Because with the tax increase, extracting from the North Sea has become unprofitable for APA. The company is now leaving the U.K., which is Britain’s loss but our gain.

See, the U.S. has even larger oil and gas reserves. It also has a president who intends to use America’s resources. And it has a growing need for cheap energy that only natural gas can fill…

The Elephant in the Server…

The force driving that growing need is AI, artificial intelligence.

AI is already the defining technology of the century. It has been available to the public only since about 2022, but MIT professors project it will increase global GDP by $7 trillion, or 7% total, over the next 10 years. That’s more of an impact than most countries have on the global economy.

Only the U.S. and China have GDPs greater than $4.5 trillion. Put another way, AI will add almost as much as the entire GDP of Germany and Japan, Nos. 3 and 4 globally, combined, to the global economy.

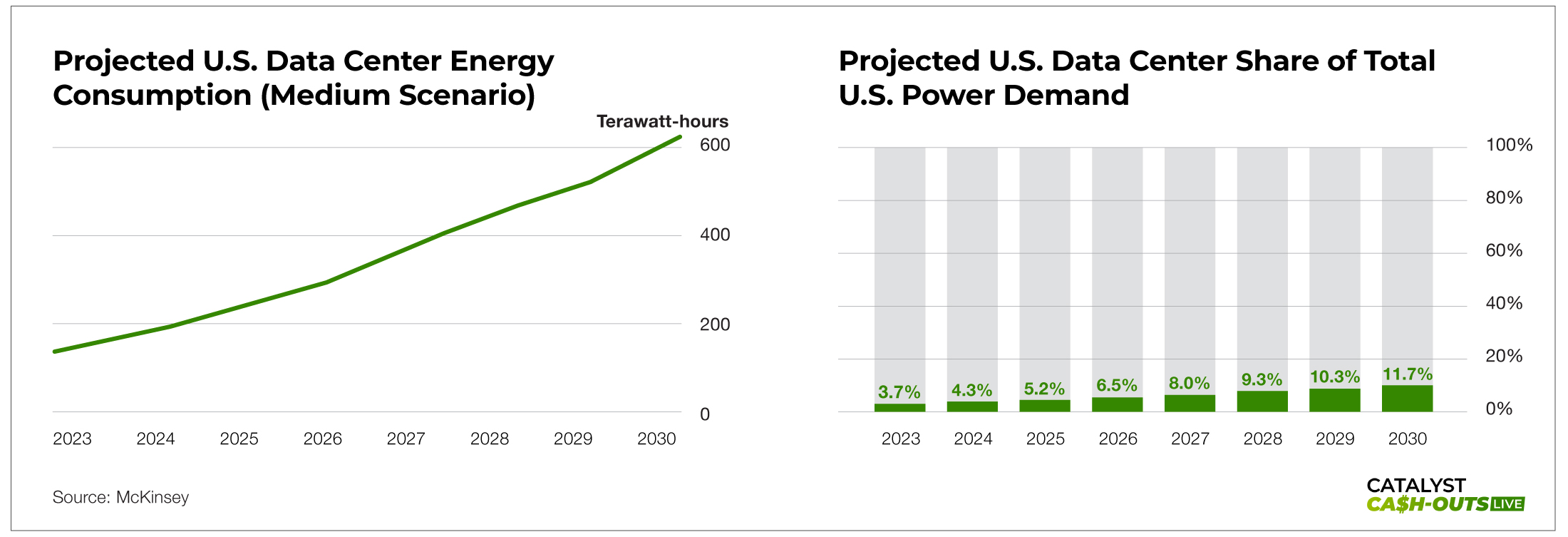

However, AI has an Achilles’ heel that is rarely mentioned: energy. It is an absolute glutton for electricity.

A ChatGPT query uses 10 to 25 times more energy than an ordinary Google search does. Users ask ChatGPT roughly 10 million questions daily. That consumes the same amount of energy as it takes to power 180,000 American homes. And ChatGPT is just one of many AI services available.

Generative AI – a powerful subset of AI that uses generative models to create new content – will use 10 times more energy by 2026 than it did in 2023.

Google’s AI uses the same amount of energy in a single hour as is needed to fully charge over 25,000 electric cars.

In fact, data centers alone already use more power than most countries.

Elon Musk has identified the problem. He’s warned Trump of an energy crisis if our power grid is not beefed up to handle the demands of an AI-driven economy.

Natural gas is the only solution available to produce the energy we need as quickly as we need it.

In his unique way, Trump said exactly that in his inauguration speech: “Drill, baby, drill.” And as he opens up America’s vast energy resources for use, APA is sure to dominate. It has always been an innovator in its industry, going back to its 1954 founding.

In fact, APA was the first energy company to use natural gas to power hydraulic fracturing. Also known as fracking, it’s one of the most energy-intensive processes in the oil and gas industry. But by using natural gas as its power source, it becomes much greener and more energy efficient.

And now APA is one of the only oil and gas companies leveraging AI technology to its benefit…

A Gas-Powered Ghost in the Machine

APA can already count the president as one of its friends. But the list doesn’t end there. The company has been partnered with AI giant Palantir for years.

The two companies signed a deal back in 2021 that integrated Palantir’s AI programs into every part of APA’s business, including operational planning, supply chain management, maintenance planning, production optimization, and contract management.

It’s difficult to quantify exactly the difference that AI integration makes for a business. But given the incredible growth APA has seen in recent years and the fact that its agreement with Palantir was expanded in September 2024, I would wager it has made quite a substantial improvement.

Speaking of improvements, APA’s bargain share price becomes almost unbelievable the moment you look at its balance sheet…

Let’s begin with its resources.

APA operates the largest continuous oil and gas deposit ever discovered in the United States. It holds 3.7 million acres with 5,000 wells in the Permian Basin and along the Gulf Coast, and offshore operations in the Gulf of America (Mexico). Altogether, it produces 143,299 barrels of oil and 467 million cubic feet of natural gas daily.

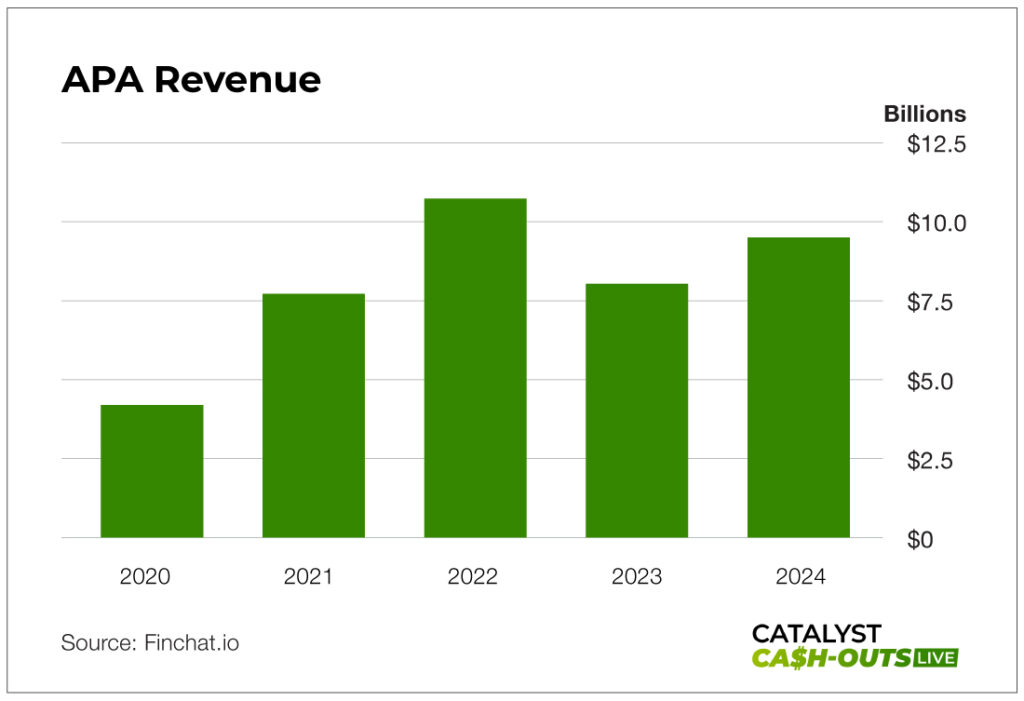

And because of the rapid rise in demand for natural gas and the need to solve the AI energy crisis, APA’s balance sheet is looking very healthy. The company’s operating income stands at $3 billion right now, but it could easily swell to over $6 billion in the coming years.

Revenue climbed by $1.5 billion over the last year alone, surging 17.26% to $9.46 billion by the end of 2024. And over the past five years, revenue has been increasing at a steady 8.3% compound annual growth rate.

The growth is already here for this stock. All it needs is a catalyst to push it into the stratosphere. I think averting the AI power crisis is that catalyst. Both Wall Street and APA’s insiders seem to agree…

Make Your Portfolio Profit Again

I won’t bury the lead: Wall Street is loading up on APA shares. At present, the big investment banks hold 88% of APA, and that percentage is growing. Bill Nygren, a billionaire considered to be one of history’s great value investors, recently almost doubled his Oakmark Select Fund’s holdings of APA to 8.2 million shares.

He’s not alone…

BlackRock has increased its position to 32.1 million shares. Charles Schwab added 12.9 million shares to its holdings. And Vanguard owns 48.6 million shares.

And it’s not just Wall Street. Company insiders are loading up on shares as well. In particular, Juliet Ellis, an APA director, bought 4,391 shares in December. And no insider has sold a single share since Q2 2022.

CEO John Christmann holds 842,800 shares, CFO Stephen J. Riney owns almost 290,000, and Senior Vice President Rebecca Hoyt holds 116,900. All of these insiders are looking at a life-changing windfall as APA solves the AI power crisis.

And you will too if you buy in now…

Something big is on the horizon for APA. It’s a unicorn in the making, and you have the opportunity to get in on the ground floor of a moonshot.

Action to Take: Buy APA Corporation (Nasdaq: APA) at market. Set a 25% trailing stop to protect your principal and your profits.