Gold is the ultimate safe haven. No matter what else is going on in the economy, gold always holds value. That’s why it, along with silver, has been the basis for just about every form of currency throughout all of human history… Until now.

Ever since the 1970s, when the U.S. abandoned the gold standard, our currency has been reduced to paper, backed by the government’s word. The result has been spiraling debt and inflation at an incredible rate.

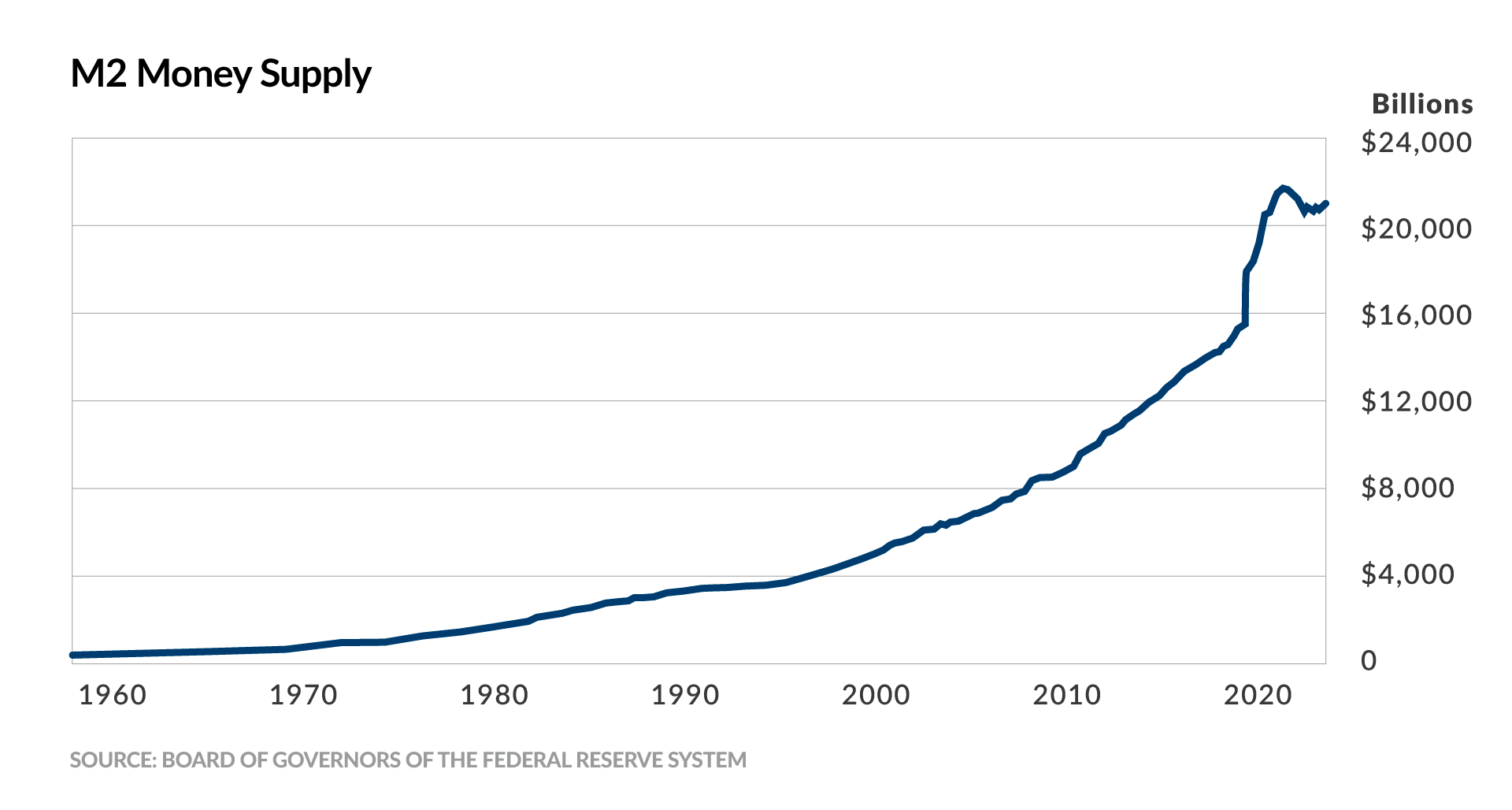

In 2020, the United States printed so much money that one-fourth of all U.S. dollars ever created to that point were printed in that year alone. As you can see in this chart, which tracks the number of dollars in circulation, inflation has been rampant since 1971.

As a result, many Americans, and indeed many people around the world, have woken up to the fragility of our fiat currency. There’s nothing behind it. So they’ve turned to gold to keep their money safe from inflation.

In the last five years alone, the price of gold has more than doubled. It’s sitting at over $3,300 per ounce, a new all-time high, higher even than the highs it reached when we first abandoned the gold standard. That’s steep for just a single ounce.

And it’s a currency you can’t really use, either. Nobody is going down to the 7/11 and measuring out gold dust to pay for their Slim Jim and Diet Coke. Things aren’t that bad for the dollar, not yet at least. But what if I told you that you could control an ounce of gold for just $20?

Sounds like a pretty great deal, right? Well, it’s not too good to be true. It’s what you can do with shares of Seabridge Gold Inc. (SA), a Canadian mining company that isn’t falling victim to one of the biggest traps of the gold mining industry. Let me explain…

Gold Miners Love Inflation…

Gold miners tend to do well when government fiat currencies inflate. People flee to it as a safe haven. But gold companies are also guilty of the same sort of inflation they profit off of.

See, whenever they need to raise money, they often create and sell more shares. That dilutes the value of existing shares in the same way that currency inflation dilutes the value of the cash in your wallet.

Barrick Gold, one of the largest miners in the world, is a prime example here. In 2007, it had 8 million ounces of gold production. Today, it produces just 4 million ounces annually. But the company has doubled its share count.

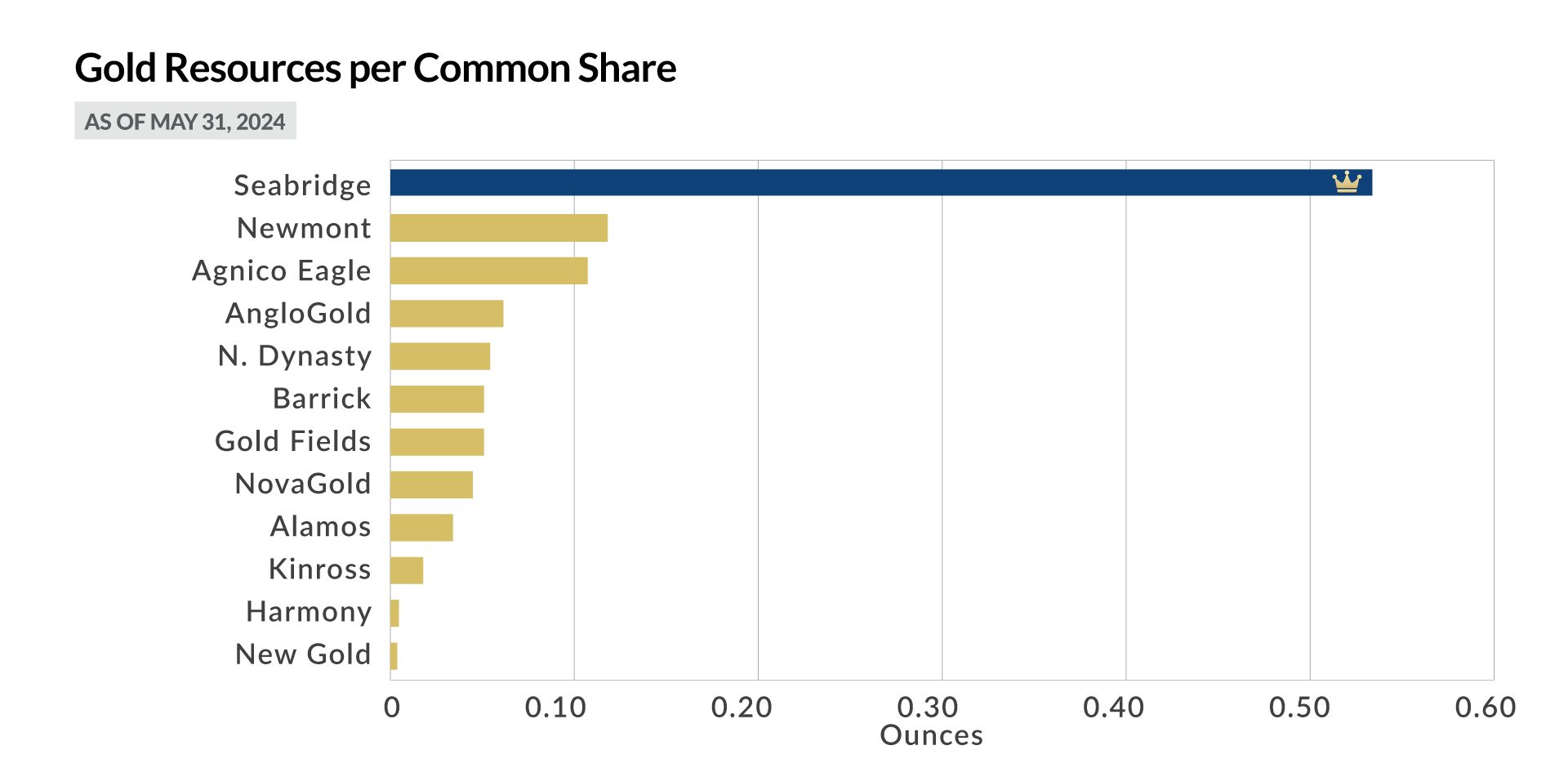

If you bought a share of Newmont, it would give you exposure to only about 0.10 ounces of gold. It’s the same story with Agnico-Eagle, AngloGold, and most other gold miners.

That’s why gold mining stocks are often difficult to make money on. But not Seabridge. No, Seabridge maintains the value of its shares by issuing roughly two share per ounce of gold it has in its reserves.

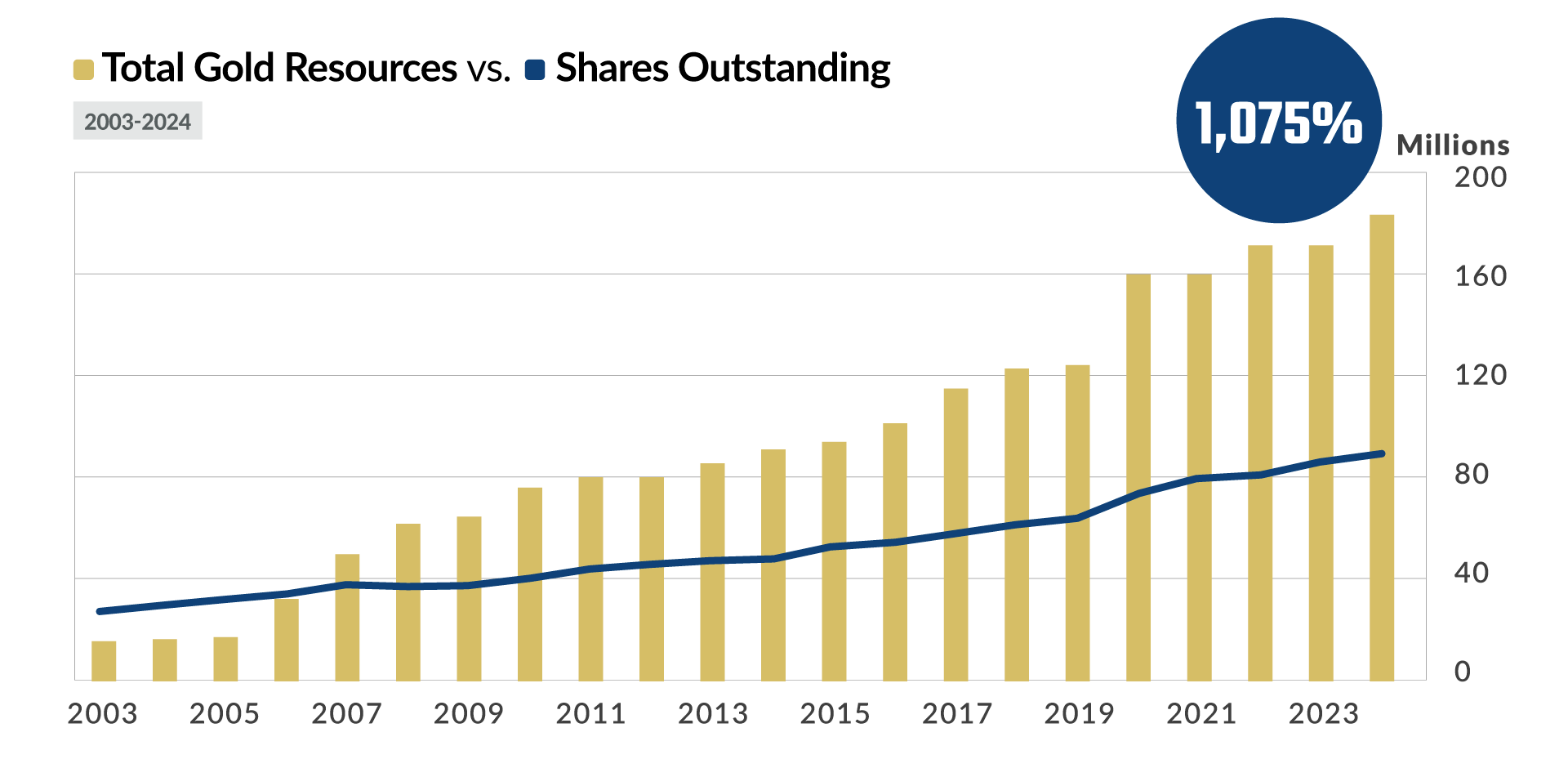

This chart makes the difference starkly clear…

So holding one share of Seabridge essentially means you own 1 ounce of its gold. And at present, one share of Seabridge is about $10 – that’s a 99.7% discount on the $3,300 per ounce you’d need to pay for 1 ounce of physical gold.

What’s more, Seabridge still has plenty of liquidity because of its absurdly large gold reserves. It has eight times more gold in its reserves than Newmont, 12 times more than Barrick Gold, and twenty times more than Kinross.

Even better, since 2003, the company has grown its resources by 1,075%, and it has made sure there will always be more gold in its reserves than it has shares outstanding.

When you buy a share of Seabridge, the amount of gold in the ground for every share you own grows over time. This is a gold mining company that actually cares about its shareholders. And the secret to Seabridge’s enormous reserves was a stroke of massive luck combined with incredible business savvy…

The Third Rule of Acquisition

When buying anything, from a car to a house to a stock, it’s best to never pay more than you absolutely have to in order to acquire it. That’s exactly what Seabridge did when it bought an underdeveloped gold project in a remote part of British Columbia from a rival miner for just $200,000.

Seabridge’s rival knew there was gold there, but it had no idea how much and didn’t want to spend the money to explore the reserves itself. So it offloaded the project for $200,000 to Seabridge, whose management thought it was a good deal.

But this wasn’t simply a good deal… It was one of the greatest gold acquisitions of the century. After exploring the parcel of land, Seabridge found it held 47.3 million ounces of gold, which is worth a staggering $141 billion in today’s market. Yet Seabridge had acquired it for pennies on the dollar.

Even if, after expenses, the company’s profits are worth only half the $141 billion, that’s still a 352,400% return on Seabridge’s $200,000 investment. The mine isn’t ready yet, but it’s getting there, and once it begins operating, you can bet Seabridge won’t stay at $10 per share for long.

What’s more, that mine also contains 7 million pounds of copper, which is worth about $26 million at today’s prices. That amount of metal makes this the third-largest copper project in the world. It’s not the main focus of this play, but it is a nice bonus.

J.P. Morgan estimates we’ll need 5 million tons of new copper just for AI alone come 2030. Factor in electric vehicle batteries and motors, wiring for new homes, and all the other uses for copper, and current mines will meet only 80% of global copper demand by 2030. Seabridge is in an excellent position to meet growing market needs with the copper in its new project.

For just $10, you can gain control of half an ounce of those 47.3 million ounces of gold and a chunk of those 7 million pounds of copper. But Seabridge has much more going for it than simply its enormous reserves. This is a strong gold miner in an industry that’s often overleveraged and cash-strapped.

The Gold Standard

Now, Seabridge really hasn’t even gotten started yet. Its gold production is still relatively small because it hasn’t yet tapped into its immense reserves. But each quarter brings it closer to operation.

In July 2024, Seabridge announced it had a “substantially started” designation from the British Columbia government. Once that mine is up and running, Seabridge has the potential to become one of the biggest miners on the planet because of one metric in the mining industry called AISC.

That acronym stands for “all-in sustaining costs.” Effectively, it refers to how much it costs a gold mining company to extract 1 ounce of gold from the ground. For example, Barrick Gold has an AISC of around $1,300 per ounce. That means it costs the company $1,300 to pull 1 ounce of gold from the ground.

With gold sitting at $3,000 per ounce, that leaves Barrick with a profit of $1,700 per ounce. That doesn’t sound bad at first… But Seabridge has an AISC of just $600 per ounce – less than half of Barrick’s.

That means each ounce can be sold for a profit of $2,400. That’s huge for investors. Here’s why…

Say you hold physical gold, a coin or a bar. If gold moves from $3,000 to $4,000 per ounce, which I fully expect it to, you’ll be sitting on a 40% gain. But for Seabridge, with gold at $4,000 per ounce, it could sell an ounce for $3,400 in profit. The costs don’t necessarily go up over time. So as long as Seabridge keeps its AISC low, the profit potential here is enormous.

Despite that, the market cap is just $982 million and shares are dirt cheap. But when I sat down with the CEO recently, he told me that he has 95% of his own wealth invested in the company. That’s how undervalued the company’s leadership sees their own stock.

I fully expect Seabridge to surge 700% during the new gold bull market. When gold experienced a bull market surge from 2001 to 2006, it went up 164%. But gold mining stocks surged as much as 719%, 875%, 958%, 1,313%, 1,617%, and even 1,832%. The same thing happened in the 166% surge in gold from 2008 to 2011, and it’s about to happen again.

The time to move on Seabridge is now. I recently sat down with the company’s CEO, and he told me that he is currently talking to six companies that will either partner with or acquire Seabridge outright.

When that happens, shares of Seabridge will skyrocket. That’s exactly what happened to Bema Gold. Anyone who bought Bema shares in 2001 would have seen a 2,388% gain when Kinross Gold bought it out in 2006.

If you get in now, you could be part of a ride like that…

Action to Take: Buy Seabridge Gold Inc. (NYSE: SA) at market. Use a 25% trailing stop.

All That Glitters…

The gold market is primed to take off. Between inflation, the actions of the Federal Reserve, the uncertainty of the election, and the growing geopolitical uncertainty around the world, people are flocking to gold.

Gold is hitting new highs we haven’t seen since the U.S. abandoned the gold standard in the 1970s. And it’s the gold miners like Seabridge that will profit. They’re the best way to play this new gold bull market.

With its impossibly large reserves and miniscule market cap, Seabridge is the best way to control an ounce of gold, and you can do that for just $10 per share.