I’m willing to bet that when you flick on the light switch at home, you don’t think much about where the electricity is coming from.

Sure, you might have some notion of a power plant somewhere… But the electrons lighting your home have been on an absolute odyssey before they were even generated at a plant.

Odds are your home is powered indirectly by natural gas. It makes up almost half of America’s energy production. It’s the cleanest of all the fossil fuels. And our reserves of the stuff are vast, some of the largest in the world.

But you can’t efficiently just load up gas on a truck and ship it to a power plant, especially not in the volume needed to generate electricity.

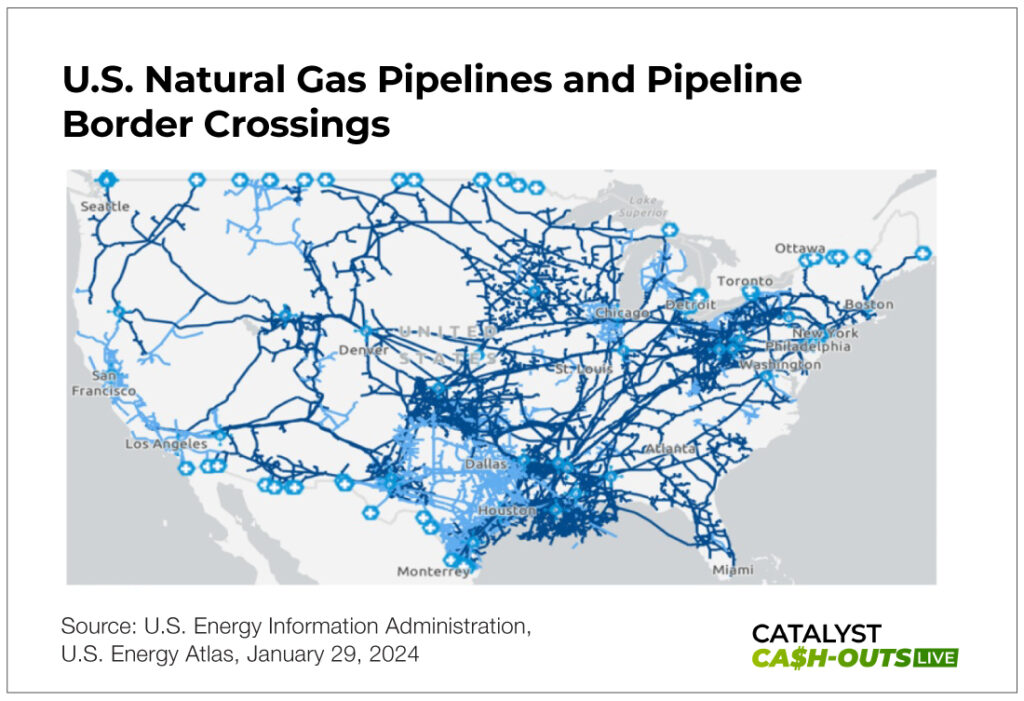

Enter the North American gas pipeline network.

That spiderweb of pipelines crisscrossing the country is why you have access to relatively cheap energy. Gas gets pulled from the ground in the various basins across the U.S. and Canada and then sent through those pipes to your local power plant and burned for energy.

And there’s one company that controls the lion’s share of that network. It collects tolls from all of the continent’s largest oil and gas producers, which rely on its pipes, and passes a vast amount of that money on to its shareholders…

It’s called Enbridge Inc. (NYSE: ENB), and its status as the energy industry’s toll collector makes it the single best income play in the energy sector right now and the perfect way to round out your AI energy crisis play…

The American Energy Superhighway

Enbridge is the best way to capitalize on the North American energy pipelines for one very simple reason. It controls a huge portion of it. At over 17,800 miles, Enbridge’s pipeline is the longest in North America. It also controls 23,800 miles of the largest export pipeline network in the world.

The company’s business model is simple and straightforward. It charges energy producers for the use of its pipelines to transport their oil and natural gas to power plants around the country and export markets around the world.

But that simple business model is incredibly lucrative…

In 2024, Enbridge took home revenue of $37.19 billion, up a staggering 22.5% over 2023’s revenue. Profits for 2024 exceeded $5 billion. Revenue has been rising steadily at a compound annual growth rate of 3.6% over the last decade. That’s not explosive like my unicorn, but it doesn’t need to be.

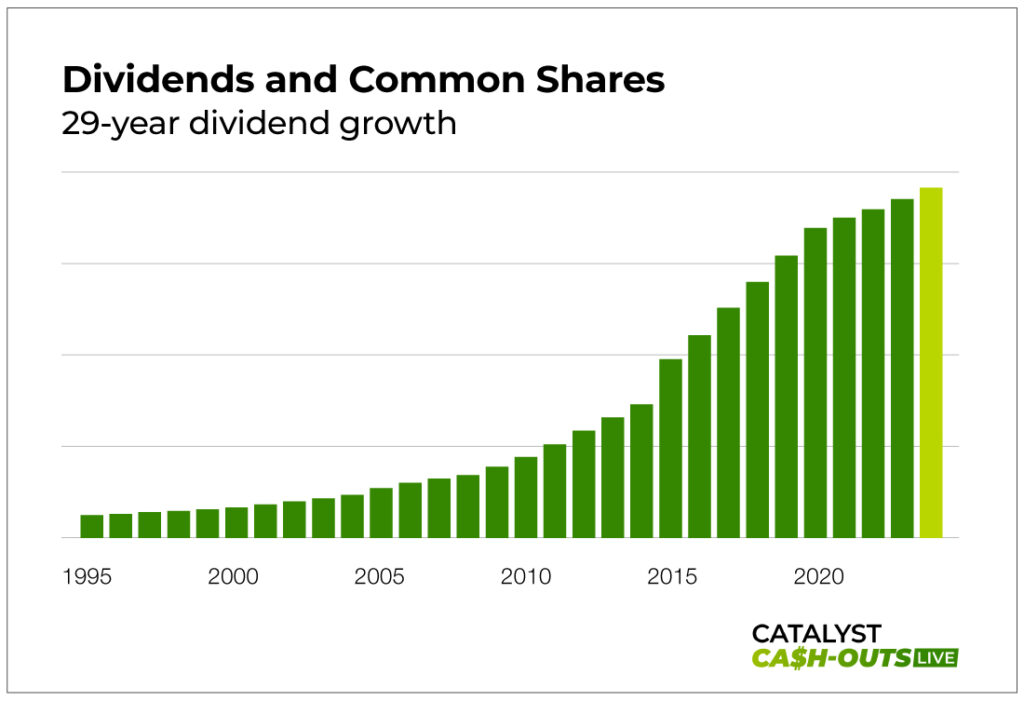

The real potential in Enbridge for your portfolio is its dividend.

At current prices, the company’s dividend yields 6.3%. That’s quadruple the dividend yield on the average S&P 500 stock.

But as energy production ramps up to meet the demand AI will put on it, Enbridge’s pipelines will see more traffic. And it won’t be a slight increase either…

The data centers used to train AI programs are gluttons for electricity. Training Chat GPT-4 alone required over 50 gigawatt-hours of electricity, around 0.02% of the electricity California generates in a year and 50 times the amount it took to train GPT-3, OpenAI’s previous model.

Fifty gigawatt-hours is a huge amount of power, and the fact that it took 50 times more energy to train GPT-4 over GPT-3 tells me this growth trend is exponential in nature, not incremental.

Columbia University projects that American data centers will consume about 88 terawatt-hours annually by 2030, which is 1.6 times the total electrical consumption of New York City.

New York, I’ll remind you, is the largest city on the entire North American continent. It has almost 8.5 million people in the city proper and 23.5 million people in its metro area.

More traffic means more revenue for Enbridge, and that means more dividends for shareholders.

The company has been raising its dividend for 29 years running, which puts Enbridge firmly in Dividend Aristocrat territory. Dividend Aristocrats are the rare dividend-paying stocks that have raised their dividends every year for at least 25 years.

That said, I do expect some serious price appreciation for Enbridge in the near future. And clearly Wall Street does as well. Vanguard recently picked up 3.6 million shares, Goldman Sachs Trust II bought 7.6 million shares, and the Royal Bank of Canada bought 1.9 million shares.

Enbridge might be the best dividend play on the market. That’s up for debate. But I know it’s the best dividend play in the energy sector. Buy some shares now, and collect a cut of the energy industry’s toll payments.

Action to Take: Buy Enbridge Inc. (NYSE: ENB) at market. Set a 25% trailing stop to protect your principal and your profits.