How to Make Money Whether a Stock Goes Up or Down

There’s no such thing as a “sure thing” in the stock market. There’s always some amount of risk, even with the safest assets you can buy. But, you can get very close with a strategy I like to call the win-both-ways trade.

It’s also known as a “strangle.”

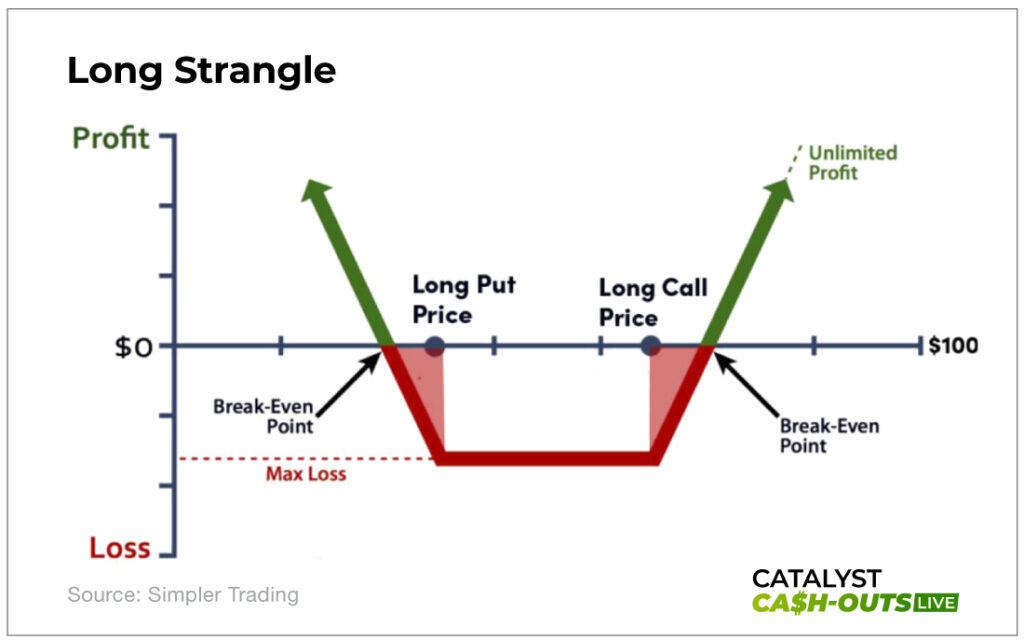

In simple terms, you set up a strangle by simultaneously buying an out-of-the-money call option and an out-of-the-money put option… with the same expiration date… on the same stock.

This establishes a position that theoretically has unlimited profit potential on the upside and limits any downside losses to a predetermined amount – the amount you spent on the options.

Set it up correctly, and you’ll have a balanced position of calls and puts on the same underlying asset on the same expiration date, but with different strike prices. Getting positioned on both sides of a trade like this forms a strangle.

Stranglehold

The goal of a strangle is to profit from a big reaction to news such as a government report, an earnings release, or clinical results for a new drug a pharmaceutical company is developing.

Those reactions can be positive or negative, but they usually result in a big swing in share price in either direction, up or down.

With a strangle, you don’t need to know which direction that move will be. When executed correctly, you’ll profit from a sizable earnings reaction either way.

Here’s how it looks if you’ve set it up correctly…

With a strangle, you limit your loss to the combined cost of setting up the trade, but your potential upside is theoretically unlimited.

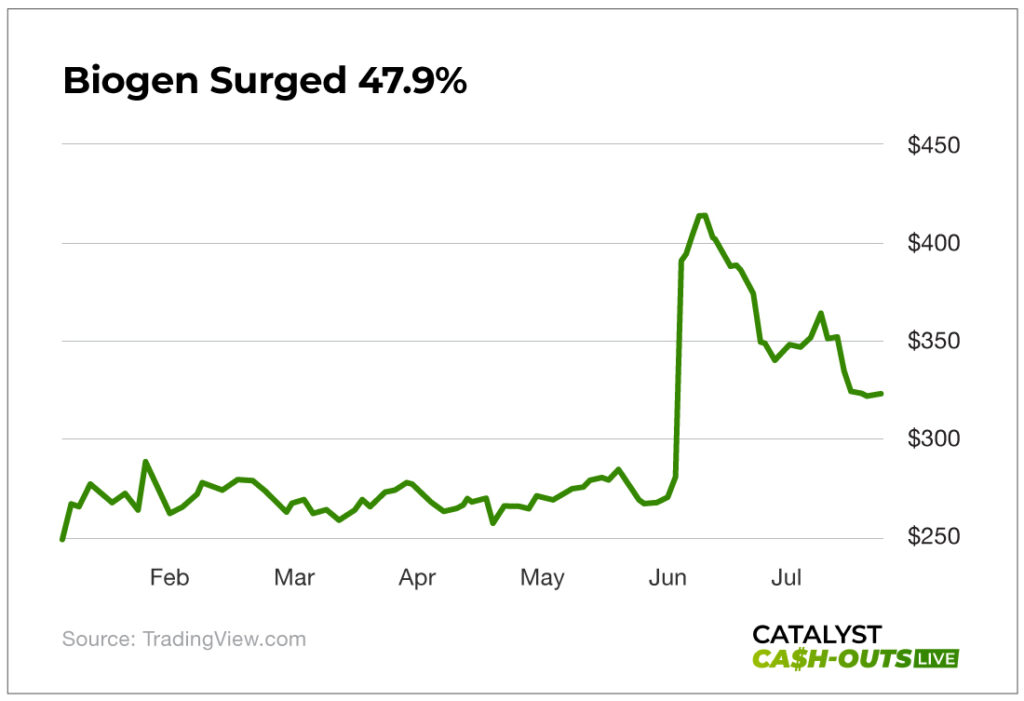

Let’s see how it all works in practice by taking a look at a big winner from my trading history, a 2021 play on Biogen (Nasdaq: BIIB)…

In 2021, the company was attempting to get its Alzheimer’s disease therapy Aducanumab approved by the FDA, and it had set a deadline of Monday, June 7 of that year for its decision.

Approval would have been huge for Biogen, and denial would have been disastrous. Here’s how it all played out…

Biogen was trading for about $265 in early February 2021. And we knew that the FDA would announce its decision in a few months. So on February 8, 2021, we bought the company’s $320 calls and its $240 puts – both expiring on July 16, 2021.

At the time, the call was trading for $25.50 per share. The put was trading for $25.37 per share. Our total cost of entry was $50.87 per share, or $5,087 in total.

We waited for about four months for our trade to play out. Again, it didn’t matter to us which way the stock moved so long as it made a big move. And boy did it…

On June 1, 2021, Biogen began a massive run up in share price that peaked on June 7, 2021 when the FDA approved the drug. In just a week, the price surged 47.9%, from $267 on June 1 to a peak of $395 on June 7. That would have been an incredible gain on the stock alone.

But our options were looking even more impressive.

Sure, our puts had gone down considerably, as you might expect. They dropped to $0.05 per share (or $5 per put) on June 7. Our calls, on the other hand, had surged to $140 per share or $14,000 per option.

Our total strangle was worth $14,005 when we sold, a 175% winner on our $5,087 initial investment. Subtract the cost of entry and we were left with a total cash gain of $8,918.

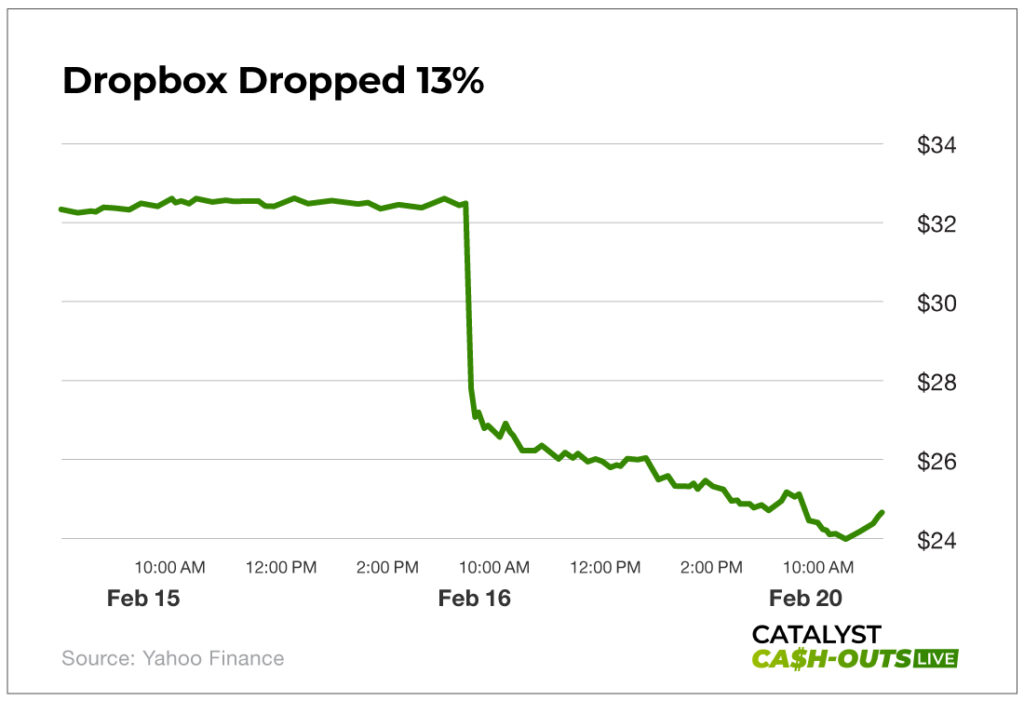

But Biogen is far from the only colossal winner we’ve had in this service. A much more recent play made on Dropbox (Nasdaq: DBX) in February 2024 is a prime example…

Dropbox was set to announce earnings the evening of February 15, 2024. And earlier that same day, I noticed that the premiums on Dropbox’s options were super cheap.

Knowing that the earnings announcement would likely trigger a big move in either direction for the stock, I recommended a strangle play.

We bought the February $33 calls and $32 puts for the best prices possible, aiming for an entry price of around $1.85.

Well, the company released a stinker of an earnings report – missing first-quarter revenue guidance and lowering its revenue forecasts.

Shares declined 13% as a result, which sent the value of our calls tumbling in value. But our puts surged.

We sold at open on the 16th and locked in a 154% overnight gain.

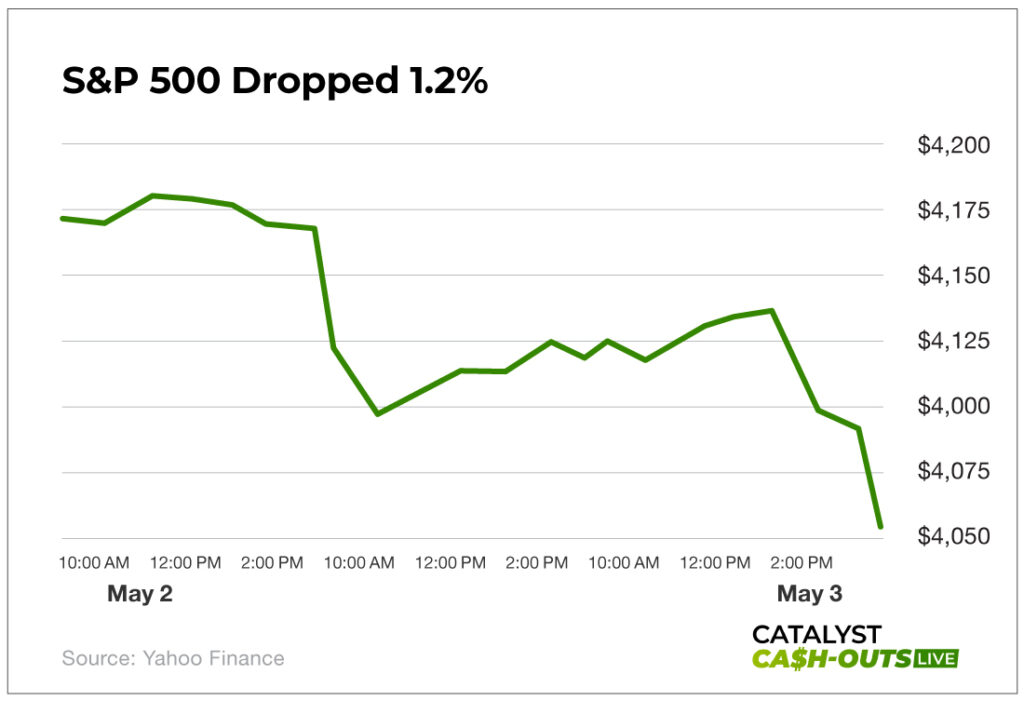

Finally, let’s take a look at an example of a JOLTS strangle from our historical backtest.

On May 2, 2023, the government released the latest JOLTS report, and it showed a weakening jobs market. New job openings tumbled to the lowest point in nearly two years.

We could have positioned ourselves the night before with a strangle on the S&P 500 ETF, which was trading for $415.51 at the time.

We would have looked for strike prices of $416 on the call and $415 on the put.

The next morning, when the report came out, the S&P 500 dropped 1.2%.

But a JOLTS strangle trade would have surged 383% overnight.

In sum, with all three of these examples, you can see that by executing a strangle, you can win if a stock or ETF goes up or down. And it benefits from two distinct advantages.

The move: Reactions to government reports are often responsible for the largest single-day move an index will make. That’s precisely when you want to be involved because that’s when the money is made.

The timing: You know the exact timing of every trade you’re going to make ahead of time. That’s because all of these reports are scheduled in advance, and we will know exactly when they’re due to be published. This allows you to plan your entry and exit orders accordingly. There’s zero guesswork involved.

Win Both Ways

When a company releases its quarterly results or the government releases financial data, or a clinical trial concludes, most traders swing for the fences and speculate on only one direction – up or down.

Sometimes they win, sometimes they lose. But even after a ton of research and preparation, it’s always ultimately a coin flip. Over time, traders doing that are unlikely to come out significantly ahead. They’ll lose as often as they win.

But with strangles, you remove that guesswork. By playing both directions together, all you care about is whether the market moves big in either direction.

When done correctly, as long as the market moves up or down significantly, you’ll win. In the process, your odds of success will increase significantly – and the chances of seeing returns of 100%, 200% or even 450% remain in your favor.