Options sound scary to many, but they’re just as easy to understand and use as stocks or bonds…

So easy that anyone can trade them…

Even if you’ve never invested in anything in your entire life.

If you’re completely mystified by options and have no idea where to begin, you’re in the right place. By the time you’re finished reading this guide, you’ll be well on your way to being an options trading pro.

What you’ll find is that options are no harder to effectively use than stocks. But they offer the opportunity for bigger, faster gains and the ability to put far less money at risk.

However, they are more volatile than stocks. That’s why they have a scary reputation. They can move down just as quickly as they shoot up, so you shouldn’t bet your retirement on a single play.

But in reality, their volatility is their strength. Options are a great way to leverage the market and amplify the moves of stock prices fivefold, tenfold or even more, no matter which way they move.

In this guide, you’ll learn everything you need to know, from understanding what an options contract is to how to place a trade…

What Are Options?

In short, an option is a contract.

It gives its holder the right – but not the obligation – to buy or sell 100 shares on a designated date and at a specified price, called the strike price.

Options come in two varieties: calls and puts.

Call options are contracts that give their holder the right – but not the obligation – to buy shares at a certain price.

It’s essentially a bet that the price of the underlying stock will rise above the option’s strike price by expiration and the contracts will give their owner the ability to buy at a discount.

When that happens, those calls are referred to as “in the money.” If a call option’s strike price is above the price of its underlying security, it’s referred to as “out of the money.”

Put options are the opposite of calls.

A put option is a contract that gives its holder the right – but again, not the obligation – to sell shares at a predetermined strike price.

It’s a bet that the price of the underlying stock will sink below the option’s strike price and the contracts will give their owner the ability to sell at a premium.

But here’s the trick: We rarely exercise the right to buy or sell shares, and when we do, it’s usually part of a larger strategy.

That’s right, we never have to own a single share of stock to make huge gains from options. More often than not, we simply buy the option (or set up an option strategy), watch the price of its underlying asset rise or fall, and then get out before it expires.

Let’s take a closer look at a call option listing from the Chicago Board Options Exchange, or CBOE, Bryan’s preferred format… (O: KO 20K50D20).

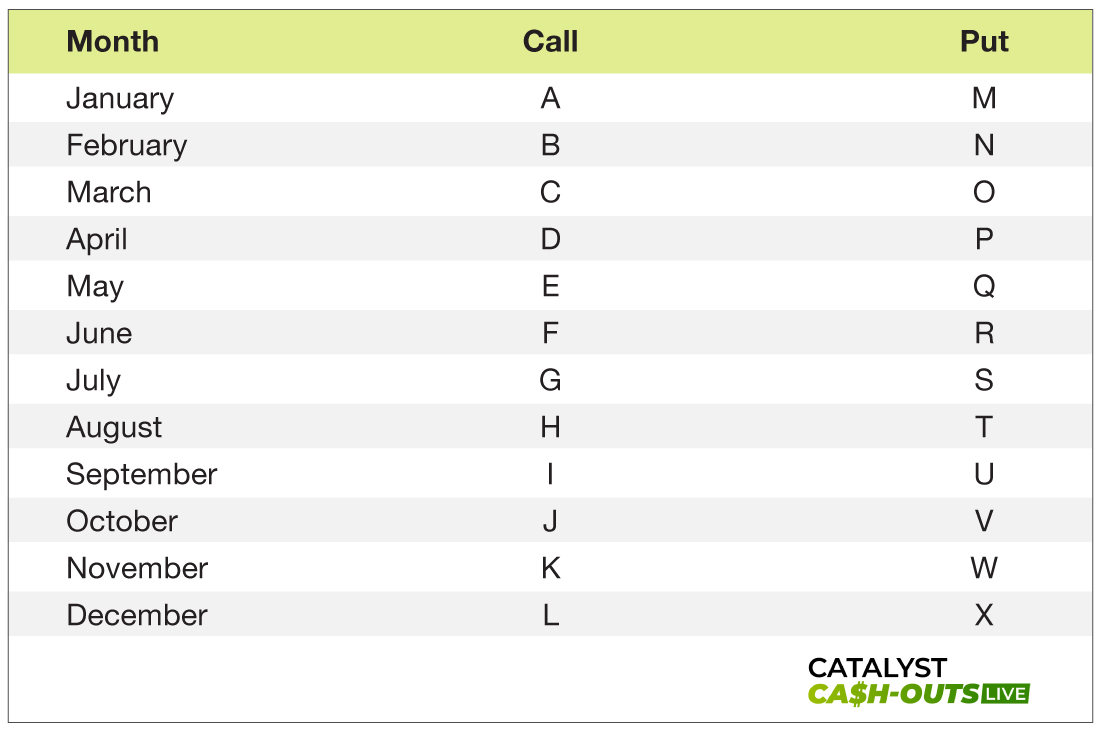

Right off the bat, you can tell this is a Coca-Cola option. The “O” just means that this is an option. It’s followed by Coca-Cola’s symbol, as that’s the underlying asset. From the “20,” you know it expires in 2020, and the “K” that follows means it’s a call that expires in November (see the chart below). The “50” number is the strike price, and the “D20” at the end indicates that this expires on the 20th day of the month. So, putting it all together, this call is a bet that Coca-Cola’s share price will exceed $50 by the expiration date on November 20, 2020.

Simple enough, but we have to discuss one of the details about options that confuses many new investors.

Say we’re looking at a Company X call option that expires in January 2025. It’s trading for $59 per share, has a strike price of $60 and is currently listed at $3.50.

Each option contract represents 100 shares of its underlying stock. That means $3.50 is the per-share premium. The actual price is $3.50 multiplied by 100, so one contract costs $350.

To buy 100 shares of Company X stock without options, you would have to lay out nearly $6,000 to buy 100 shares at $59. The option costing only $350 is a pretty great bargain by comparison.

For example, if the value of an option’s underlying shares moves just 5% to 10%, the options associated with it could move 50% to 100%… and sometimes even more.

Here’s how things might work with our Company X play…

Say we buy in for $3.50 now, and at the January 17, 2025, expiration date, Company X is sitting at $70. That’s $10 above our strike price, so we could exercise our option here and buy 100 shares at a $10 discount per share. We could also sell our options at expiration for $10, or $1,000 ($70 share price minus $60 strike price), which would be a 186% return on your $350 investment.

Now say we had bought 100 shares of Company X outright at $59 and sold at $70. That’s a gain of 19%, or $1,100. Our return was higher with the option, and we put considerably less money at risk – less than 6% of the cost of 100 shares at market.

We were in for just $350, while stock investors were in for $5,900. That means if our trade had gone south and Company X had plummeted, we would just be out $350 when our calls expired worthless. On the other hand, stock investors using a customary 25% trailing stop could have lost as much as $1,475, or 25% of their $5,900 investment.

That’s a lot of information to take in, but the more of this guide you read, the more options will make sense.

What’s Going on With Options Pricing?

Buying options is really no different from buying stocks, at least in terms of how you do it. Most online brokers will let you trade them. You don’t need some special permit or title.

Once you’ve set up your brokerage account to trade options, in almost every case, it’s as simple as clicking buy or sell.

But there are some more key terms to understand before you can trade options effectively.

First, what makes up the price of an options contract?

Well, there are two parts to it. The number you see next to the option listing is its premium, the $3.50 in our Company X example. That’s the amount you pay for each share, which means you multiply it by 100 to get the value of the whole contract. The important thing to note is that the per-share price of an option is almost always significantly lower than the price of the stock that it tracks.

An option’s premium is made up of two factors: the option’s intrinsic and extrinsic value. Intrinsic value is the difference between the current share price and the strike price.

For example, let’s say you bought our Company X call example for $3.50. Like we showed at the beginning, the strike price of the option is $60 and the stock is currently trading for $59. Right now, your call is out of the money. It has no intrinsic value whatsoever.

However, if the stock price ticks up above $60, say to $65, like in our example, your option will shoot up in value too. To find out how much, you subtract the strike price from the current share price ($65 minus $60). Your options are now worth $5 in intrinsic value.

With the intrinsic value, we can also understand how much the share price needs to move before we can profit. To do that, we add the price of the premium to the strike price.

In the case of our example, that would be $3.50 plus $60, which equals $63.50. That means our break-even price is $63.50, and any share movement higher is profit.

Now, say the share price leaps up to $70. Then the intrinsic value of our option would leap to $10 ($70 minus $60). It would be even more with the extrinsic value included, but that’s a bit more difficult to calculate.

Now, a win like that is rare and would leave us with a 186% gain. That’s a serious winner, but we have seen even bigger. Some subscribers have walked home with gains of 1,000%, 2,000% or even greater with a more advanced options strategy called a “legged spread.” It’s not a frequent occurrence, but it illustrates the sorts of returns you can potentially make with options.

The remaining value of an option premium is its extrinsic value. It’s also referred to as the time value of the option. It’s comprised of implied volatility, which fluctuates along with market demand for options, as well as days to expiration. The market price of an option minus the intrinsic value gives you the extrinsic value.

Extrinsic value decreases the closer you get to the option’s expiration date. So how does all this work?

Well, let’s take our Company X example…

Say we buy in at $3.50 like before.

If the share price doesn’t move, the extrinsic or time value of $3.50 will slowly degrade to $0 at expiration.

That’s because the extrinsic value is all about potential. It’s based on the chance the underlying stock has of moving up or down.

As such, the closer to expiration an option gets, the less chance there is for its underlying stock to move and the less potential the option has of being in the money.

That’s why you should always set a clear exit strategy before buying an option. You can’t rely on the option’s potential forever, and you don’t want to be left holding the bag when it expires.

That said, there is somewhat less risk with buying options in the sense that there’s less money on the table.

You position yourself to reap massive gains while putting less money at risk upfront.

How Does the Options Market Work?

Now that you understand what goes into the price you pay for an options contract, let’s talk about how the market buys and sells options.

Each options contract has a bid price and an ask price. They’re also known as the bid and offer. It’s a two-way price quotation that illustrates the best-shown price at which the option can be bought or sold at any given time. It is very possible to trade at a price different from what is shown in the bid-ask market.

The bid price represents the maximum price that a buyer is willing to pay for an options contract. While the ask price, or offer price, represents the minimum a seller is willing to take for the same options contract.

A trade can occur only after the buyer and seller agree on a price for the option, which is at or between the bid and the ask prices.

The difference between the bid and the ask is called the spread. The smaller an option’s spread, the more liquidity it has and the easier it is to trade. This premium spread should not be confused with a vertical options spread, a strategy for an options play.

To the average investor, the bid and ask spread is an implied cost of trading.

For example, if you’re looking at an option that reads $1/$1.05, someone looking to buy the option would pay $1.05 ($105), while the person selling it would receive $1 ($100) if they were to execute the trades at the current market prices. The $5 difference is pocketed by the market maker.

How Do I Actually Trade Options?

The process of actually buying and selling options is fairly simple, and not too dissimilar from trading stock. There are a couple of extra steps, but the bottom line is this: If you have an account and some money to trade with, you’re already (mostly) set.

You just have to contact your broker and let them know you’d like to trade options. You can do so either on your account or by setting up an account specifically for options trading. To trade options, your account needs to be Level 2 to Level 5.

(Note: For most of the trades we will be doing in Catalyst Cash-Outs Live, you will need option Level 3 access – especially to do strangles on the SPY for our government loophole trades.)

If you’re new to options trading, be sure to read all the material they send you before you start trading. You should talk to your broker and have all your questions answered until you feel comfortable.

It might take some time to familiarize yourself with all the intricacies of options trading, but setting up an account to trade can be done in as little as five minutes.

If you don’t have a brokerage account, get one as soon as possible. Time is money – don’t waste it.

You can use any online brokerage to trade options. If you work with a full-service broker, that’s fantastic, but really, any of the big online ones will do. Charles Schwab, Fidelity – all of them will get the job done.

Sometimes there will be fees. However, after Robinhood made commission-free trading mainstream, most large brokers don’t charge any fees or commissions on stocks or options.

Contact your broker to learn more about what, if anything, they charge. Those charges can add up quickly if you’re doing the sort of fast-paced trading we do.

Now, buying stock is simple. You just log in to your brokerage account, search by the company’s symbol or name, select the number of shares you want and click buy.

Buying options is just as easy, but it has a couple of extra steps. Start by looking up the options available for the stock you want.

When you’ve found your option, identified by its expiration date and strike price, click “buy to open,” “sell to close” or whatever is required to execute our strategy. We will give you the details on that for each trade.

There’s a bit more to it when we get into more complex strategies, like put selling or setting up a vertical spread, but for your first basic options trade, it’s just that simple. Now get out there and start trading!