The AI energy crisis we are facing is a problem every American energy company will be attempting to solve. To expand America’s AI capabilities, we will need to boost our electricity production immensely…

That means more power plants, more infrastructure, and, most critically, more fuel. America has immense oil and natural gas reserves that our energy producers will tap into and profit from…

But one of the best plays isn’t an energy producer at all.

No, the company featured in this report doesn’t drill for any oil or natural gas itself. Instead, it provides the services needed to run the equipment and operations.

You’ve likely heard of a “pick-and-shovel” company.

The term was coined for the businesses that would sell picks and shovels to gold miners in California during the Gold Rush. They made out like bandits because they cashed in regardless of whether gold was found.

And SLB, (NYSE: SLB) formerly Schlumberger Limited is the premier pick-and-shovel play for the AI energy rush.

At Your Service

Based in Houston, Texas, SLB (which changed its name in 2022 and is still referred to as Schlumberger Limited in many places) provides end-to-end technological support for the energy industry. And it was founded in 1926, so it has a century of experience under its belt.

So what does technological support mean for the energy industry?

For SLB, it means aiding in the planning, engineering, and logistics of well construction, optimization services for existing wells, digital tracking of reservoir performance, and implementation of an expansive suite of software tools to improve oil and gas production on all levels.

Put more simply, SLB provides all the proverbial picks and shovels an oil or gas producer needs to optimize its operations, enhance production, and improve efficiency – all while reducing the carbon footprint of its operations.

There are many companies around the world that make use of SLB’s expertise, and it’s local in 120 countries. And each of those companies needs SLB to tailor a solution to its very specific needs. Universally, SLB’s solutions make an immense difference…

In 2021, Norwegian oil company Lundin Norway hired SLB, which digitally integrated automation for Lundin’s pumps. The result was rigs that operate faster and with less downtime – and a 74% reduction in carbon dioxide emissions.

In 2022, KJ Energy, an American company, hired SLB to improve the capabilities of its onshore operations in Panola County, Texas. The abrasive rock formations of the Cotton Valley Formation caused KJ Energy’s drills to wear out faster than normal, and replacing the heads of those drills caused significant downtime. SLB made some modifications to the drill heads so they would last longer and require fewer swaps, speeding up the drilling process by 28%.

Those are just a couple of case studies out of dozens that have seen SLB make a world of difference for an oil and gas producer. It has a consistent and reliably profitable business solving problems and providing equipment to the industry.

No matter what energy markets do, SLB keeps chugging along and producing more sales every year.

And business is booming…

The Great American Gas Rush

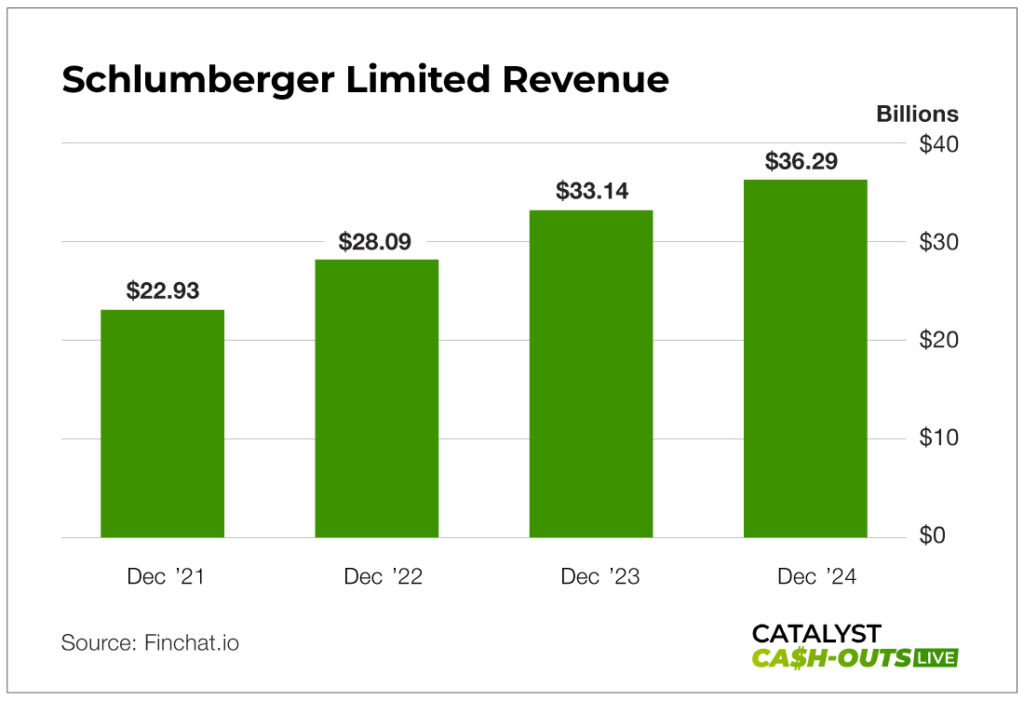

SLB’s bottom line and steady growth are beyond impressive. Let’s start with sales: The company has seen sales explode from $22 billion to $28 billion, $33 billion, and $36 billion over the last four years. For 2024 it saw year-over-year sales growth top 9.5%.

Over the past five years, the company has seen its revenues increase at a compound annual growth rate (CAGR) of 2%. That sped up to 16.5% over the past three years. Diluted EPS growth over the past three years is even more impressive, topping 33%.

SLB is also an income-generating machine. It had $4 billion in cash flow last year, of which $3.27 billion was paid out to shareholders through dividends. And the company announced it expects to pay shareholders more than $4 billion in 2025.

At present, SLB’s dividend stands at $1 per share, which yields 2.8% at the company’s current share price of about $40. It’s not as incredible a bargain as APA (few companies are), but it’s impressive nonetheless, and the stock is at a bargain price for what SLB offers.

The company also has a cash position of $4.71 billion to further grow its operations and a manageable debt load. Its price-to-earnings ratio stands at 13.2 and its price-to-book is 2.7, which is on the lower end when compared with its industry peers. That indicates it’s an incredible value relative to other companies in the space like Archrock Inc. (NYSE: AROC).

The catalyst for SLB to take off is straightforward and all but guaranteed…

As American oil and gas producers scramble to build out their domestic capabilities to meet the demands of AI, SLB should be swimming in fresh contracts for all manner of support.

Wall Street is already buying up shares in anticipation. Vanguard has expanded its position to 136.4 million shares, T. Rowe Price recently bought 5.3 million shares to bring its total position to 76.1 million, and Morgan Stanley has grown its position to 17.2 million shares.

It’s obvious why investment banks are buying. SLB is growing at an incredible pace, it’s trading at a valuation that’s less than half that of the average S&P 500 stock, and it has amassed a war chest full to bursting with cash.

With the “drill, baby, drill” mentality of the Trump administration sure to benefit SLB, Wall Street is eagerly diving into the deep end…

And I believe you should too. Add this incredible income play to your portfolio before its share price takes off.

Action to Take: Buy SLB (NYSE: SLB) at market. Set a 25% trailing stop to protect your principal and your profits.