When it comes to precious metals, silver often stands in the enormous shadow cast by its more glamorous cousin, gold. It’s ingrained in our culture and our minds that silver is second place, the first loser.

But historically, silver has ironically been more useful as the “gold standard” than gold itself. See, the reason gold and silver are valuable is that, chemically, they are very nonreactive.

What that means is they don’t corrode or oxidize like other metals. That makes them a reliable store of value. If you drop a piece of iron into a river, it will be reduced to rust before too long. But gold and silver at the bottom of a river will still be pure and untarnished after decades or even centuries.

There is also a lot more silver on this planet than gold, so it has historically been even more useful than gold as coinage. The Spanish Empire is the prime example here…

See, the conquistadors who followed in the footsteps of Christopher Columbus did so in search of gold. That’s where the myth of El Dorado comes from, a city entirely constructed out of gold somewhere in Mexico or South America.

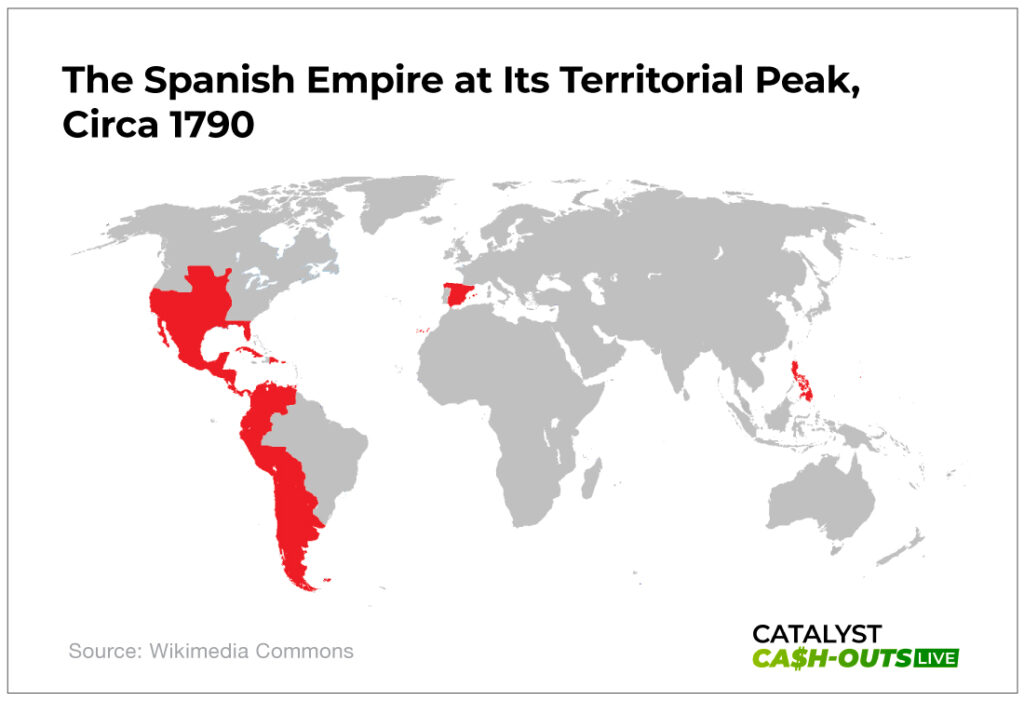

Those conquistadors did find some gold, but they found a lot more silver. They found an entire mountain of the stuff in what is now Bolivia, in fact. Those silver shipments back to Spain funded an army and navy that could not be rivaled by any one power in Europe or Asia.

It transformed Spain into the world’s first global superpower. It was the first empire upon which the sun never set. That phrase is more associated with the British Empire today, but it was coined in reference to Spain.

And every once in a while, a sunken treasure ship full of Spanish silver is found at the bottom of the Atlantic. And that silver is still pure even after centuries at the bottom of the ocean.

Silver is far from second best. There’s more of it than gold, sure. But smart investors then and now know it’s just as good an asset as gold. In fact, silver could hand you even bigger profits than gold during a bull market.

See, when gold goes up, silver historically rises twice as much. We saw exactly that play out during the last Federal Reserve rate cut. Silver exploded from $9 an ounce in November 2008 to more than $55 by April 2011.

That’s a staggering 399% gain to gold’s comparatively paltry 109%.

But here’s where it gets really exciting. Right now, silver is at a historical low compared with gold. The gold-to-silver ratio, which has a 30-year average of 67, is sitting at 101-to-1 right now.

The ratio tracks the relative value of gold to silver by expressing how many ounces of silver it takes to purchase 1 ounce of gold. So right now it takes 101 ounces of silver to buy just 1 ounce of gold.

Silver’s price is completely out of whack and primed for a massive correction. When that happens, silver prices can soar…

A Silver Bullet for Your Portfolio

There are two catalysts coming that could very easily send silver into the stratosphere. The first is obviously the Federal Reserve rate cut that’s all but guaranteed at this point. The Fed has to cut rates or risk economic implosion.

When that happens, inflation will begin ticking back up and, in response, people will flock to precious metals. Gold, of course, but also silver. When that happens, silver will surge.

The second catalyst is the high gold-to-silver ratio. When that corrects, silver will also surge. The last three times such a correction occurred, all happened when the ratio was over 80 – right now, it’s nearing 90. And silver surged 40%, 300%, and 400%, respectively.

Beyond that, the fundamentals for silver are stronger than ever.

The Silver Institute recently reported that demand for the metal reached a new high in 2024. It was the fourth year that demand has exceeded supply…

This supply deficit, combined with increasing industrial demand for silver in electronics, could result in a price explosion for silver.

However, I don’t recommend you buy physical silver. There’s a much better way to play it…

The Silver Lining

I’m recommending you buy LEAPS on iShares Silver Trust (SLV). For the uninitiated, LEAPS stands for Long-Term Equity Anticipation Securities. LEAPS are options with expiration dates that are very far out.

A normal option will usually expire within the year it’s created, but LEAPS are options that expire in one year, two years, or even three years. They’re the way to go when you expect a market trend to cause a big move but can’t pinpoint when exactly it will happen.

For example, a precious metals bull market. Every indicator says one is coming, but we can’t predict exactly when that will happen. So we are going to be buying LEAPS to ensure we have a play in place for when the bull market starts.

And iShares Silver Trust is one of the best ways to get cost-effective access to physical silver and exposure to the precious metals market. The trust is very simple and straightforward. It holds physical silver, and when you buy shares in it, you have exposure to the value of that silver.

Right now, the trust holds 448 million ounces of silver. And it’s already showing returns on the coming bull market. Since the start of 2025, the trust is up 11% and costs $30 per share at the time of writing.

The trust is pegged directly to the price of silver, which is $33 per ounce at the time of writing. When the price of silver surges, the iShares Silver Trust will follow suit.

That’s why I recommend you buy the iShares Silver Trust January 2026 $27 calls to profit from the coming bull market.

Action to Take: Buy the January 2026 $27 call LEAPS on iShares Silver Trust (NYSE: SLV) under $4 until December 30, 2025. If not filled under $4 by December 30, 2025, cancel your order. Use a 50% stop loss.