When most people think of investing in precious metals, they think of literally buying physical gold or silver.

But as I’ve shown readers through this premium report as well as my other reports on gold mining stocks and silver trusts, there are many ways to invest in precious metals. And that means there is guaranteed to be one that caters to your financial needs and goals.

Gold royalties are one of my favorite ways to invest in gold. (Warren Buffett is quite fond of them too.) When you own a royalty, whenever revenue is made, you get paid. And you don’t have to incur all the cost or risk involved either.

See, the gold mining industry has a lot of overhead. Miners need loads of capital to explore and acquire land with gold under it. That alone can run $100 million to $150 million. Then there’s all the mining equipment you need, including machinery and trucks. On top of that, you need to take care of the local environment around your mine during its life and, in many countries, repair the environment once the mine is depleted. I could go on, but I’m sure you get the idea.

Most companies don’t have that sort of capital just lying around. Enter gold royalty companies. These firms provide miners with upfront capital to develop their mines and, in exchange, receive a cut of either the metal or the revenue produced by the mine.

Some of these companies operate on a streaming basis, which works similarly. But instead of a cut of the metal or the revenue, streaming companies can purchase the mine’s metal at a discounted price and then sell it at market for an immediate profit.

For an investor, gold royalty companies give you all the benefits of owning shares in a mining company but without the risk. See, a mining company can go bankrupt if a project goes awry. But a royalty company will be just fine.

Royalty companies don’t carry the insane debt loads of many miners, and they’re insulated from the operational risks and cost overruns common in the industry.

And most royalty and streaming companies return value to shareholders not necessarily through share appreciation (although that is always possible) but through dividend payments, which is a plus for income investors.

The company I’m focusing on in this report, Toronto-based Franco-Nevada Corporation (FNV), does both royalties and streaming and pays its shareholders a healthy dividend.

If you’ve already built a portfolio to profit from precious metals via shares in a miner like Seabridge Gold and LEAPS on a silver trust, then Franco-Nevada is the ideal way to play gold over the long term with a wealth-generating asset that can snowball over time if you play your cards right…

A Cut Off the Top

In terms of how it operates, Franco-Nevada is the textbook example of a royalty company. But its strength comes from how it has invested its capital into its royalty streams.

The company holds royalty and streaming rights to 432 assets around the world. Of those assets, 118 are producing, 39 are in the advanced stages toward becoming producing, and 276 are in the exploration stage.

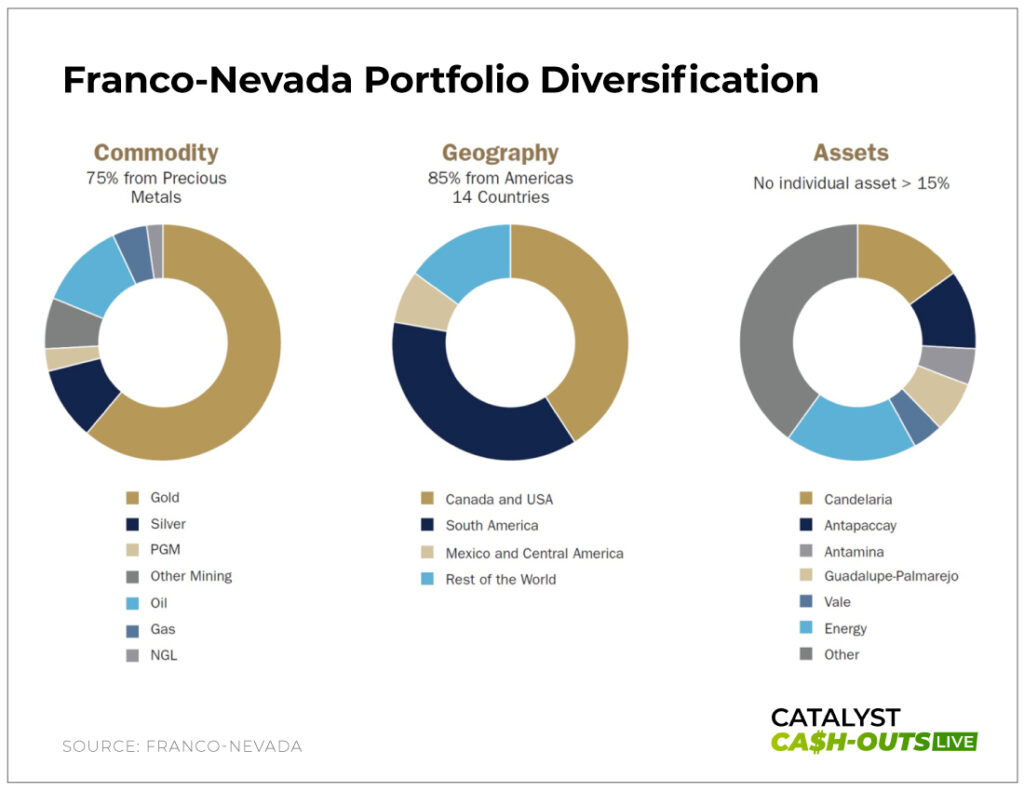

Most of those royalties are from gold, silver, and other precious metals. Those make up 75% of Franco-Nevada’s assets. But the company also holds royalties and streams in the energy industry, namely in oil and gas.

These assets are well diversified across 14 countries, 84% of which are in the Americas. Importantly, no individual asset makes up more than 15% of Franco-Nevada’s portfolio. This ensures that Franco-Nevada is largely insulated from any issues that one individual investment might encounter.

It’s a well-diversified portfolio that delivers a low-risk, income-producing investment for shareholders.

In 2024, Franco-Nevada brought in $1.1 billion in revenue and $552.1 million in net income. In addition, it grew its cash reserves 2.1% to $1.45 billion. Free cash flow topped $421.5 million, and the company returns that cash to shareholders via a healthy dividend.

The company has grown its dividend every year since 2009 – for 16 years running. At present, it yields 0.9%.

Franco-Nevada presents a serious opportunity for price appreciation in a gold bull market. In fact, it has one of the most proven track records in its industry. During the Great Recession, from December 2007 to June 2009, stocks dropped 35% while gold rose 22%…

Meanwhile, Franco-Nevada’s stock price increased 84%.

Gold continued that rise through 2011, gaining 91%. Meanwhile, Franco-Nevada surged 153%. And when gold fell 18% from 2011 to 2014, Franco-Nevada actually surged 54%. Gold miners got slaughtered, but Franco-Nevada grew. It has all the benefits of investing in gold and mining companies but with much less risk.

Starting from the S&P 500’s low in 2009, the index is up 381% today. Meanwhile, Franco-Nevada is up 1,100%. And I predict that as this next gold bull market sends gold’s spot price into the stratosphere, Franco-Nevada will continue its incredible bull run.

You’ll want to invest now to make sure you profit alongside Franco-Nevada…

Action to Take: Buy Franco-Nevada Corporation (NYSE: FNV) between $120 and $125. Set a 25% trailing stop to protect your principal and your profits.

Richer Than Midas

The gold market is primed for a major bull market. Between the most chaotic election in recent American history, growing geopolitical uncertainty across Europe, Asia, and the Middle East, and a U.S. dollar on life support, people are turning toward precious metals in a way they haven’t since former President Richard Nixon abandoned the gold standard in 1971.

Now is the time to build a portfolio to profit from gold. Because the best way to play precious metals isn’t by buying physical gold but by investing in gold miners like Seabridge, purchasing LEAPS on silver, and adding shares of my favorite gold royalty company to your portfolio.

By making those three moves, you’ll set yourself up perfectly to play the next gold bull market. Franco-Nevada is the ideal long-term play to round out your portfolio and give yourself the best chance at being richer than King Midas when all is said and done.