While Wall Street focuses on AI stocks and investing in traditional markets, the crypto revolution is quietly reshaping the global financial system. Unfortunately, too many investors are still sitting on the sidelines, missing the opportunity of a lifetime.

After the brutal bear market of 2022, cryptocurrency markets roared back to life in 2023 and 2024. In 2025, prices remain dramatically higher, though volatility remains.

Access to crypto has never been easier or more legitimate. Starting in 2024, you can buy Bitcoin and Ethereum through mainstream brokerage accounts via spot ETFs. Or you can bypass the middlemen entirely and purchase digital assets directly on crypto exchanges. This isn’t speculation anymore – it’s financial evolution.

If you’ve never bought crypto before… this guide will get you started safely and simply.

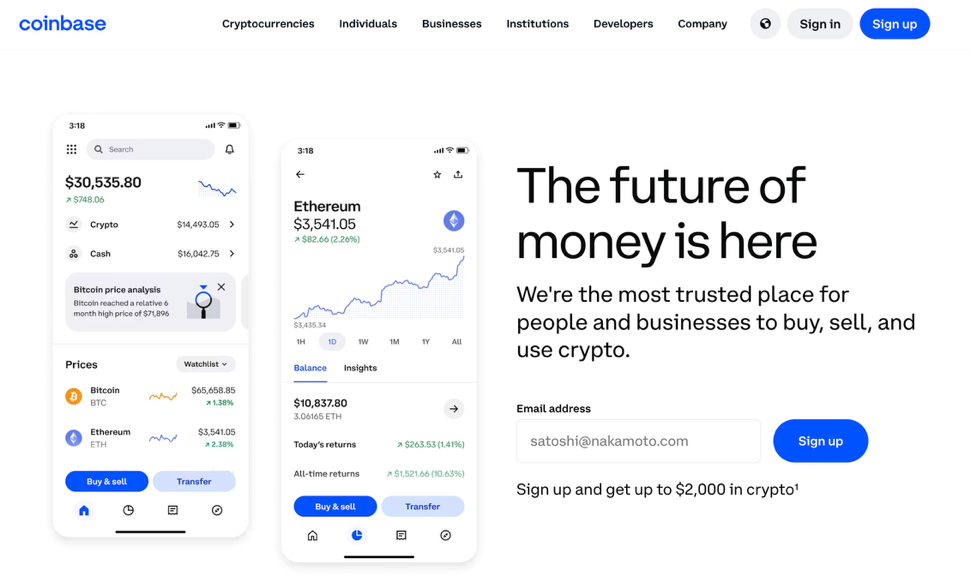

Getting Started: Create an Exchange Account (Example: Coinbase)

There are many reputable U.S. exchanges. For simplicity, we’ll illustrate with Coinbase because it’s beginner‑friendly and has strong educational tools.

Account setup (with helpful how-to links):

- Create an account with your email and a strong, unique password.

- Enable two‑factor authentication (2FA) on day one (authenticator app or security key recommended).

- Complete identity verification (Know Your Customer): upload a government ID and confirm personal details (name, DOB, address, employment/income questions).

- Link a bank account, debit card, or wire for funding.

Important Note: U.S. cash balances held for you at partner banks may receive pass‑through FDIC coverage up to applicable limits. Digital assets themselves are not FDIC or SIPC‑insured.

Your First Purchase

Let’s say you want to buy $100 of Ethereum (ETH). These are the steps you’ll follow on the website using your computer or laptop.

- Search for the symbol ETH.

- Select Buy on the Coinbase homepage.

- Enter an amount to buy.

- Select Pay with and choose or confirm your payment method.

- Select Buy and choose or confirm the asset you’re buying.

- Select Review order to confirm your purchase details.

- If the details are correct, select Buy now to complete your purchase.

On the Coinbase app, the steps are similar:

- Access the Coinbase mobile app.

- Select Buy & sell.

- Choose Buy.

- Select the asset you’d like to buy.

- Enter the amount you’d like to buy.

- Select Review order to review your purchase.

- If all the details are correct, select Buy now to complete your purchase.

You can find helpful videos here on Coinbase’s website.

Where to Keep Your Crypto: Wallets 101

You can leave coins on the exchange (custodial) or move them to a self‑custody wallet you control. Many investors do both (small trading balance on exchange; long‑term holdings in self‑custody).

Wallet types:

- Hardware (“cold”) wallet: A small device that stores your private keys offline (examples include Ledger and Trezor). Best balance of security + usability for long‑term holdings.

- Mobile/software (“hot”) wallet: An app (e.g., Coinbase Wallet) that lets you self‑custody and transact easily. More convenient, but exposed to device risks.

- Paper wallet: Printing keys/QRs on paper. Advanced only. Easy to make mistakes; not recommended for most users in 2025.

Best practices:

- Generate and back up your seed phrase offline; consider a durable metal backup.

- Verify addresses on‑device before sending.

- Keep devices updated; beware of phishing; never share seed phrases or 2FA codes.

Everything You Wanted to Know About Crypto (2025 Edition)

What Is Cryptocurrency?

A digital asset that can be bought, sold, or exchanged over decentralized networks. Transactions settle on a blockchain – a tamper‑resistant public ledger.

How Many Cryptos Are There?

Listing sites now track tens of thousands to millions of tokens, but only a few hundred are widely traded with meaningful liquidity. Treat new or obscure tokens with caution.

What’s So Special About Bitcoin?

Launched in 2009, Bitcoin is the first and most widely held decentralized digital money. Its supply is capped at 21 million, enforced by code and network consensus.

What Was the Latest “Bitcoin Halving”?

Roughly every four years, Bitcoin’s new‑issuance block reward is cut in half. The most recent halving was in April 2024, reducing the reward from 6.25 BTC to 3.125 BTC per block.

What’s an “Altcoin”?

Anything that isn’t Bitcoin – ranging from smart‑contract platforms (Ethereum, Solana) to niche application tokens.

What’s a “Stablecoin”?

Tokens designed to hold a stable value (often $1) by being fully reserved or over‑collateralized. The category has grown rapidly; focus on reputable issuers with clear, frequent attestations.

Why Are Fees Sometimes High?

Most blockchains charge network fees (e.g., Bitcoin miner fees; Ethereum gas). Fees vary with network demand and the complexity of your transaction. They are not zero.

What Is “DeFi”? What Is “Staking”

DeFi uses smart contracts to offer financial services without traditional intermediaries (lending, trading, payments).

Staking (on proof‑of‑stake chains) means locking tokens to help secure the network and earn rewards.

Where Do I Buy Crypto in 2025?

You have two clean paths:

Path A. Brokerage‑Only Exposure (Simple):

- Buy spot Bitcoin (BTC) and Ethereum (ETH) ETFs in a standard brokerage account (e.g., Schwab, Fidelity). No wallets required.

Path B. Direct Crypto (More Control):

- Open a crypto exchange account (e.g., Coinbase), buy your coins, then transfer long‑term holdings to a hardware wallet.

Robinhood: Offers direct crypto trading with a large coin lineup and broad U.S. availability. Check its live “coin availability” page for the current list and any state nuances.

Binance.US: Availability varies by state and can change; always confirm the latest state‑by‑state status before onboarding.

Taxes: What You Need to Know (U.S.)

- Crypto is typically taxed like property: sales and swaps can trigger capital gains/losses; rewards/interest can be ordinary income.

- Starting January 1, 2025, certain crypto broker transactions must be reported to the IRS on Form 1099‑DA (statements furnished in 2026 for 2025 activity). Keep clean records.

Consult a tax professional for personal guidance.