The #1 Moonshot Crypto in the World: Why XRP Could be Headed to $92

For years, I’ve been a crypto skeptic.

I called it “fake internet money” and steered clear of the mania.

But every once in a while, an opportunity comes along that’s simply too powerful to ignore.

That opportunity today is XRP — a $3 crypto asset with a unique combination of Wall Street backing, political tailwinds, and technology advantages that put it in position to be the most explosive trade of the next 12 months.

In this report, I’ll walk you through exactly why XRP could soar from $3 to as high as $92 — a 3,000% gain — and everything you need to take action right now.

The Big Catalyst: $8 Billion Ready to Pour Into XRP

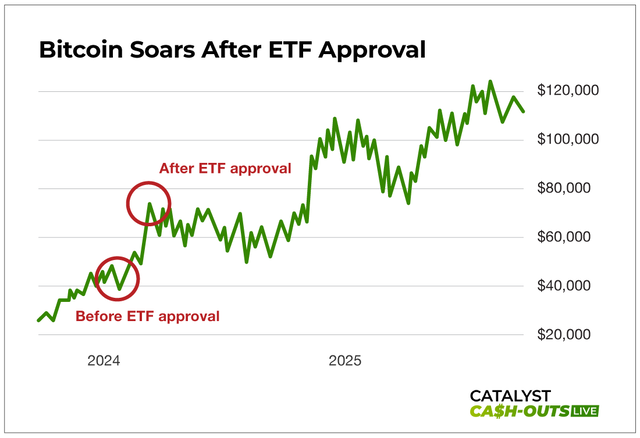

Last year, The Securities and Exchange Commission (SEC) stunned the market when it approved 11 Bitcoin ETFs on January 10, 2024.

The result? Tens of billions of dollars flowed into Bitcoin practically overnight, sending its price soaring. Leading up to the approvals, Bitcoin was trading between $45,000 – $48,000 per coin. But after a few months, it pushed past $70,000 to new all-time highs.

Then all the way to highs of up to $120,000 by mid-2025.

Now, Wall Street is preparing to do the same thing with XRP. There are nine XRP-focused ETFs currently in the works, backed by some of the same financial giants that pushed Bitcoin higher: JPMorgan, Fidelity, BlackRock, and others.

What we do know — current status of XRP ETF filings

Based on multiple filings and regulatory notices, here’s the current status of 6 of the 9 current XRP ETF filings:

| Issuer | Type of ETF proposed | Filing status / Key deadlines |

| WisdomTree | Spot XRP ETF | Filed Dec 2, 2024. SEC acknowledged. Decision expected Oct 24-25, 2025. Coinpedia Fintech News |

| Franklin Templeton | Spot XRP ETF | Filed; under review. 60-day extension; decision date moved to Nov 14, 2025. Coinpedia Fintech News |

| CoinShares | Spot XRP ETF | Filed Jan 24, 2025. Decision expected Oct 25, 2025. Coinpedia Fintech News |

| Rex-Osprey | Spot XRP ETF | Filed Jan 21, 2025. Launched September 18, 2025. |

| 21Shares | Spot XRP ETF | Delayed. Their review deadline extended to October 19, 2025. Mitrade+1 |

| Grayscale, Bitwise, Canary Capital | Spot XRP ETF proposals | Amendments / updates submitted. All still under review with SEC delaying Grayscale decision until Mid-October 2025. Mitrade+3CoinCentral+3Coinpedia Fintech News+3 |

The First XRP ETF Launch: $37.7 Million in-flows on September 18th 2025

Rex-Osprey, the brand name for investment firms REX Financial and Osprey Funds, filed for a spot XRP ETF under the SEC’s S-1 form on January 21, 2025.

The proposed ETF (XRPR) had been structured under the Investment Company Act of 1940. That is big because it’s a more common structure for regulated funds in the U.S.

XRPR launched on Sept. 18, marking the first U.S. listed exchange-traded fund to offer spot exposure to XRP. The launch resulted in a record-breaking $37.7 million in trading volume on its first day.

That’s just one ETF approval, and several more ETF decisions are scheduled for Mid-October and November 2025.

According to a JPMorgan analysis, these 9 total ETFs could attract $8 billion in new investment capital once approved.

And inflows of that size could have a major impact on the value of XRP.

For context:

- A mere $80 million inflow earlier this year triggered a $17 billion surge in XRP’s market cap within hours — a 212X multiplier.

- A $12.8 million inflow pushed the value up by $7.7 billion in a single day — a 601X multiplier.

- A $17 million inflow sent XRP’s market cap soaring by $11 billion — a 647X multiplier.

If just tens of millions can trigger billions in gains, imagine what $8 billion could do.

Even the most conservative math puts XRP at $32 per coin, and if the higher multipliers hold, the target is closer to $92 within 12 months.

Other analysts predicting a $100+ XRP

- Matthew Brienen (CryptoCharged): Has suggested that with mass adoption in remittance payments, XRP could reach between $100 and $1,000 within a decade (by 2035).

- Andrew Forte (Unfungible): Predicted XRP could reach $100 by 2037.

- Armando Pantoja (analyst): Suggested XRP could eventually reach $1,000 if market conditions are favorable and Ripple resolves its legal issues.

- Andrei Jikh (crypto pundit): Outlined several factors that could contribute to a rally $100, including the conclusion of the SEC lawsuit, institutional adoption in Jpaan, and the approval of spot XRP ETFs.

- “Crypto Sensei” (market expert): Predicted a potential surge past $1,0000, driven by capital inflows and a market capitalization multiplier effect.

- “Barri C” (@B_arri_C on X): Has published a forecast predicting an exponential surge to $100 by 2025 and $1,000 by 2027, though this is considered highly bullish.

- Javon Marks (crypto expert): Based on technical analysis of the 2017 bull run, has forecasted that XRP could reach $99.

If those political plans materialize, XRP wouldn’t just be a speculative trade — it would be the foundation of an entirely new U.S.-backed financial system.

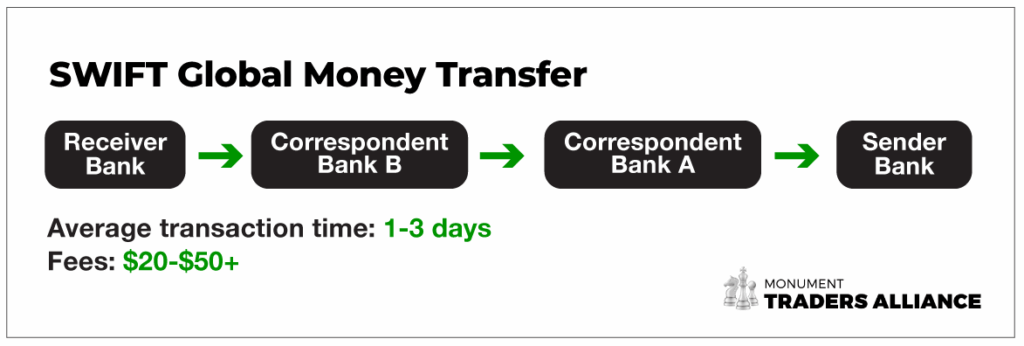

How SWIFT Works (the current method for global money transfers)

SWIFT stands for “Society for Worldwide Interbank Financial Telecommunications.” It’s the traditional backbone of global money movement.

But it’s important to understand that SWIFT is just a messaging system. It’s not the actual money mover.

For example, when someone sends money overseas, banks use SWIFT messages to tell each other how to debit and credit accounts.

For example, say Bank A (based in U.S.) wants to send money to Bank B (based in Germany), those two banks often don’t have a direct account with each other.

So they would use a large intermediary bank like JPMorgan.

These larger banks act as middlemen between the two banks that don’t have a relationship.

JPMorgan would debit Bank A’s USD account and issue a credit to the Bank B’s German correspondent USD account, which then releases euros on the other side.

The problem is this process is slow (1-3 days transaction time), expensive (multiple banks add fees), and opaque (you don’t know where your money is mid-transfer).

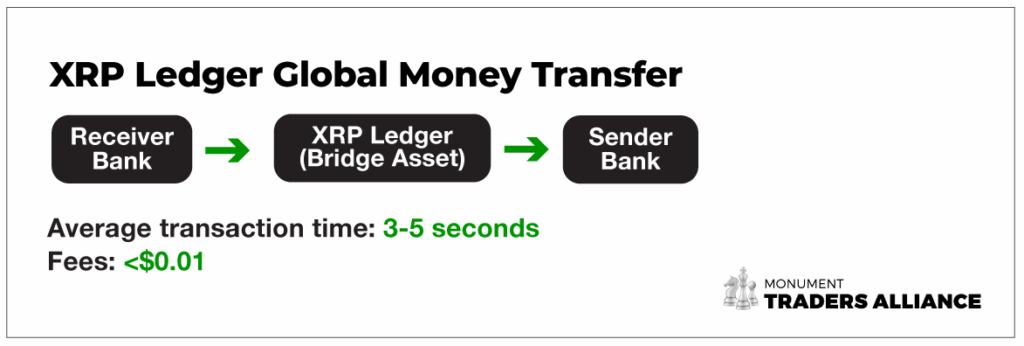

Ripple’s new XRP Ledger Technology for Global Money Transfers

Unlike SWIFT, which is just a messaging network, Ripple built a blockchain known as XRP Ledger (XRPL).

Its native asset is XRP cryptocurrency, which is used to pay transaction fees for cross-boarder transfers. Because it’s open source, nobody owns the XRP Ledger blockchain, just like nobody actually owns Bitcoin.

Here’s an example of how this XRP Ledger blockchain could improve the global money transfer process…

Say a bank wants to send $10 million USD to Japan.

Instead of needing a pre-fund bank account in Yen, the bank would convert USD < XRP, send XRP across the ledger in seconds, and the recipient instantly converts XRP < YEN.

The settlement is almost immediate, and costs a fraction of a cent. No bank intermediary is needed. It’s all done on the blockchain.

So while SWIFT just tells banks what to credit and debit, XRP actually moves the value.

Why XRP Could Replace the Old SWIFT Model

While you wouldn’t necessarily need XRP to convert YEN to USD, Ripple has pitched XRP as the bridge asset that could replace or complement SWIFT’s $5 trillion/day traffic.

Instead of SWIFT messages bouncing between multiple banks, value would be transferred directly via XRP.

This is why some speculate that governments or big institutions could adopt XRP at scale.

Key players backing XRP…

U.S. President Donald Trump signed an executive order on March 6, 2025 to formally establish the Strategic Bitcoin Reserve and create a “digital asset stockpile.” The order specifically names XRP among the assets to be held.

This kind of government-level interest is a big signal – it suggests institutions could follow if the policy environment supports it.

Brad Garlinghouse, the CEO of Ripple, also points to the approval of spot XRP ETF filings as a major catalyst for wider institutional adoption.

XRP Technology: Faster, Cheaper, Better Than Bitcoin

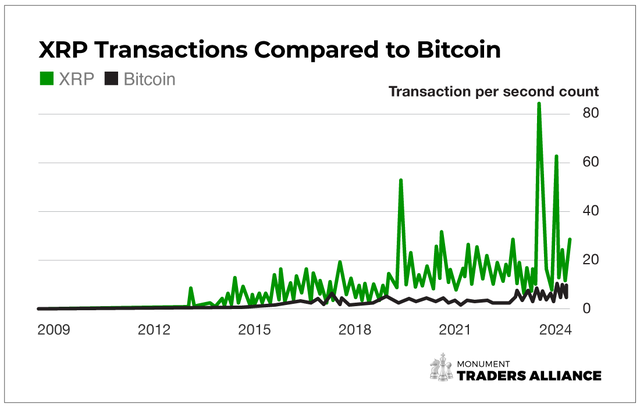

Beyond politics and Wall Street money, XRP’s underlying technology makes it a standout.

Unlike Bitcoin, which was created as a storage for “digital gold,” XRP’s Ledger technology is built specifically for payments and remittances. Making it more effective as a quick settlement across borders.

Bitcoin uses a Proof-of-Work mechanism that requires 30-60 minute wait times for transactions, while XRP Ledger (XRPL) uses a consensus protocol among trusted validators, which means transactions settle in 3-5 seconds with immediate finality.

Below is a chart illustrating the difference in transactions per second between XRP and Bitcoin.

And XRP has one more unique feature: supply burn.

Every time a transaction occurs, a small amount of XRP is destroyed. This means the more it’s used, the scarcer it becomes — a built-in driver of long-term price appreciation.

The Multiplier Effect: Why XRP Could Hit $92

The math behind XRP’s surge potential is simple supply and demand.

- Supply is shrinking: XRP holders are locking coins in cold storage, and every transaction reduces the overall pool.

- Demand is rising: Nine ETFs could soon open the floodgates for institutional money.

Bank of America once calculated that each dollar into Bitcoin translated into a 118X increase in market value because of thin supply. XRP’s multipliers have been far higher — up to 647X.

That’s why even the conservative scenario (212X multiplier) pushes XRP to $32. The aggressive scenario ($8 billion x 647X) brings XRP to $92 within a year.

How to Take Action: Buying XRP

Buying XRP is straightforward.

- Ticker Symbol: XRP

- Where to Buy: Available on major exchanges including Coinbase, Kraken and Binance.

- How Much to Invest: Crypto is highly volatile. The beauty of XRP’s upside is that even a small investment can deliver meaningful returns. Consider using only risk capital (“fun money”), not retirement savings.

For example:

- A $500 stake at today’s price could turn into $15,000 if XRP hits $92.

- A $1,000 stake could turn into $30,000.

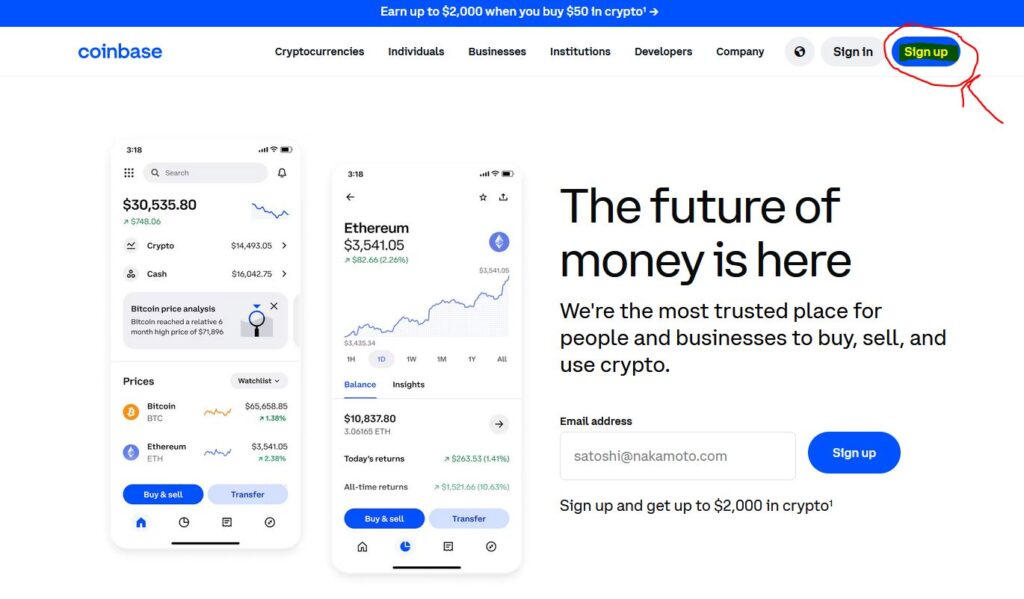

How to Setup a Coinbase Account

1. Go to Coinbase

- Visit coinbase.com

- Make sure you’re on the official site/app — there are phishing sites out there.

2. Create Your Account

- Fill out instruction form

- Verify your email address via the link Coinbase sends.

3. Verify Your Identity (KYC)

Because Coinbase is regulated, they require ID verification.

- Provide date of birth, address, phone number.

- Upload a photo of a government-issued ID (driver’s license, passport, etc.).

- Sometimes they’ll ask you to take a selfie to match with your ID.

4. Add Payment Method

- Link a bank account (recommended for larger purchases).

- Or add a debit card (faster, but usually has lower limits and higher fees).

- In some regions, PayPal is available for deposits/withdrawals.

5. Secure Your Account

- Turn on two-factor authentication (2FA) (Google Authenticator or Authy app is safest).

- Consider enabling Coinbase’s vault feature if you plan to hold larger amounts.

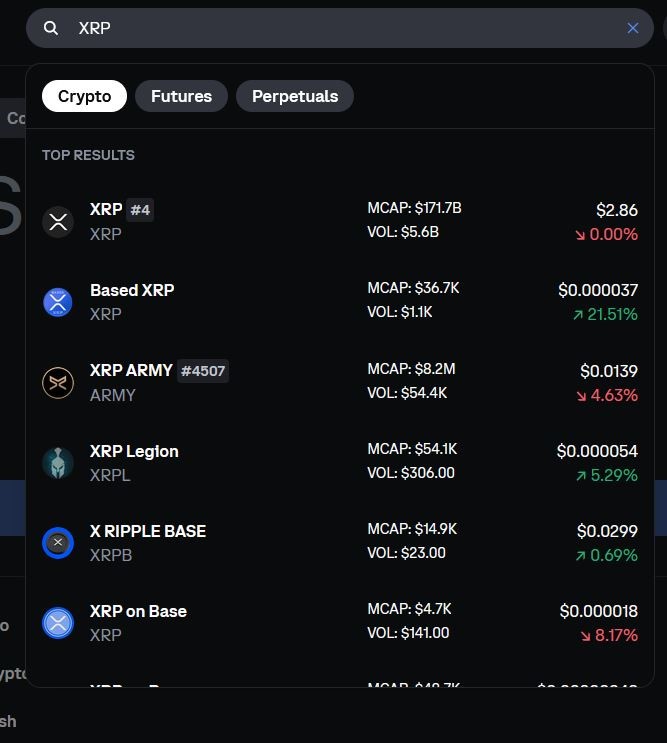

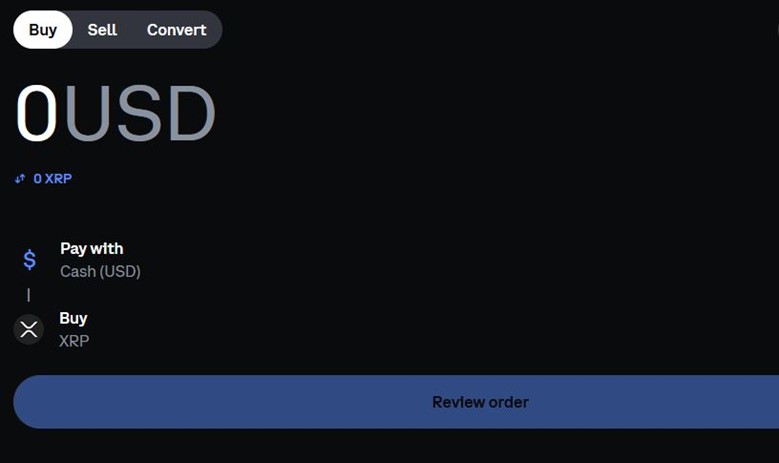

6. Buy Crypto (Example: XRP)

Once verified and funded, go to “Trade” → Search “XRP.

- Choose “Buy” and enter how much USD (or your local currency) you want to spend.

- Confirm the transaction — your XRP will appear in your portfolio.

For more information on setting up your account, click here for our report “The Beginner’s Blueprint: How to Buy, Store, and Protect Crypto in 2025.”

Why This Matters Now

Timing is critical. The first ETF approval could come any day. Once that happens, XRP could spike instantly as billions flow in.

This is exactly what happened with Bitcoin — by the time most retail investors noticed the ETFs, the easy money had already been made.

Right now, XRP sits at $3. With $8 billion in inflows on deck, a shrinking supply, and Trump’s political tailwinds, the conditions are lining up for one of the biggest moves in crypto history.

Final Word

I’ve never been a fan of crypto speculation. But when I see a setup like this — Wall Street money, political backing, real-world utility, and explosive math — I can’t ignore it.

XRP (Ticker: XRP) could very well be the trade of the decade.

If the ETFs are approved, $8 billion could pour in, creating a multiplier effect that pushes XRP to $92 in the next 12 months. That’s a potential 3,000% gain.

The time to act is before the ETFs go live. Once the floodgates open, $3 entry prices may be gone forever.