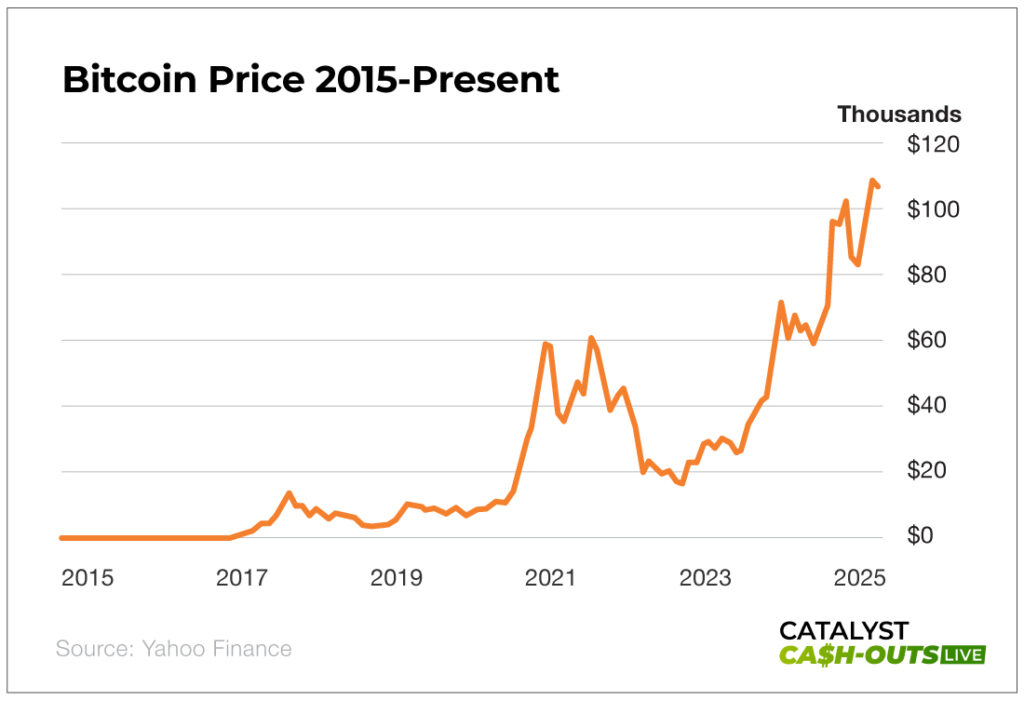

Bitcoin is set for an incredible moonshot over the next few years, one that will make its ascent to $100,000 look minuscule by comparison.

The stars are aligning for the original cryptocurrency.

And there are three reasons it’s poised to hit $500,000 in the next few years.

First, President Trump is the first pro-crypto president. His actions are certain to drive up the price of Bitcoin. His reelection alone helped push Bitcoin to kiss the $100,000 mark at the tail end of 2024. Just 72 hours after beginning his second term, the president signed a pro-crypto executive order, and Bitcoin accelerated well above $100,000.

The second reason is that Trump is not even remotely done directly bolstering cryptocurrency. His most ambitious plan for Bitcoin is building up a strategic reserve of the cryptocurrency.

The president will be forced to order a purchase of existing Bitcoin from current holders, as there will only ever be 21 million of them in circulation. As a result, the price of Bitcoin will surge as the U.S. government piles on buying pressure.

And the United States isn’t the only country doing this. China, El Salvador, Bhutan, and others are buying up Bitcoin as a reserve asset as well, which will further accelerate Bitcoin’s growth to a potential $500,000.

Third, institutional money is pouring into the cryptocurrency from names like Goldman Sachs, Morgan Stanley, Wells Fargo, Bank of America, and many more. They’re all spending hundreds of millions, if not billions, of dollars on cryptocurrencies. Much like the buying pressure from governments around the world, this will continue to drive the price of Bitcoin (and likely some other cryptocurrencies as well) through the roof.

But with Bitcoin sitting at well over $100,000 at present, the asking price for even a single token is impossibly steep for most people. Fortunately, there is a backdoor way to play Bitcoin, one that doesn’t require you to pay even 1% of $100,000 but that will allow you to capture even bigger gains than buying and holding Bitcoin.

To 3X your money with this “Bitcoin Backdoor Trade,” all you need to do is…

Take a Flying LEAP

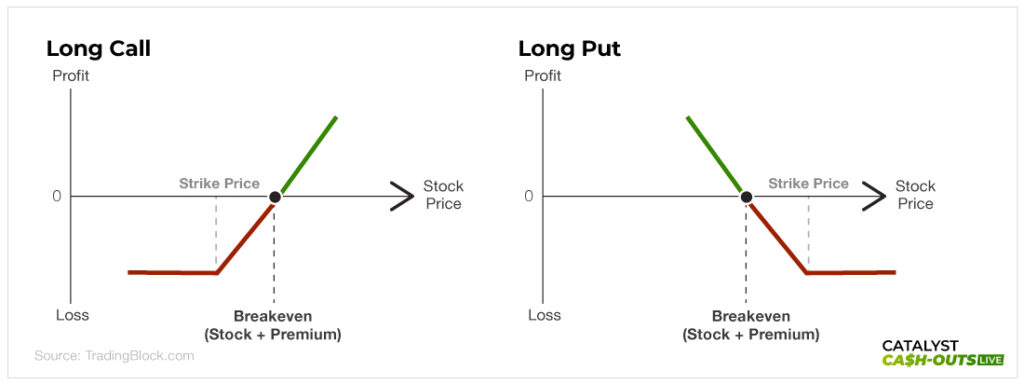

The way to play Bitcoin is by buying LEAPS. Long-Term Equity Anticipation Securities, or LEAPS, are a form of option. Mechanically, they work exactly like the weekly or monthly options you likely already know, and they come in two varieties: calls and puts.

However, LEAPS have their expiration dates set much further out than their ordinary option counterparts. Generally speaking, anything with an expiration date further than one year out is a LEAPS option.

Aside from their expiration dates, though, LEAPS work exactly like any other option. You buy calls if you think the underlying asset will rise in value and you buy puts if you think it will decline in value. The further above the strike price the share price goes, the more valuable a call will become. The further below the strike price the share price goes, the more valuable a put will become.

So the difference between LEAPS and regular options is minuscule. But where LEAPS are especially useful is in playing long-term trends. Traditional options are meant to capture gains on market trends in the next few minutes, days, weeks, or sometimes months. It’s only with LEAPS that you can use the power of options to leverage yearslong trends like the growth of Bitcoin.

What Trump is doing with cryptocurrency will play out relatively quickly, but it will still take a few years to bear fruit. You can’t play it with ordinary options. So I am recommending you buy LEAPS on one specific asset to play the crypto revolution.

It’s called the iShares Bitcoin Trust ETF (Nasdaq: IBIT),and it’s the cheapest and easiest way to give your portfolio exposure to Bitcoin.

Bitcoin Made Easy

Despite all the hype, buying cryptocurrency remains a somewhat difficult and involved process. You need an account on a crypto exchange, and you need a digital wallet to store any crypto you do buy. It’s doable, but not as simple as buying stocks has become, for instance.

But the Bitcoin Trust ETF gives you exposure to Bitcoin without you ever needing to own a single token. The fund simply holds Bitcoin and allows other people to buy shares of it to gain exposure to the moves the asset makes.

At present, the Bitcoin Trust ETF holds nearly 660,000 Bitcoin, which have a market value of $72.6 billion at current prices. And the ETF simply moves in lockstep with Bitcoin in the market at a nearly 1-to-1 ratio. The ETF’s year-to-date return at the time of writing is 17.06%. Bitcoin’s year-to-date return at present is 15.06%, so right now the ETF is performing slightly better than the asset it’s pegged to.

The key difference is that a single Bitcoin will set you back $107,000, whereas a share of the Bitcoin Trust ETF is just $62 – less than 1% of the cost. And an option will cost you even less per share than that. So this ETF will give you exposure to all the moves made by Bitcoin for less than pennies on the dollar.

Currently, LEAPS on the Bitcoin Trust ETF go out to 2027 and range in price from $5 per share to $30 per share, depending on the strike price. For a full contract controlling 100 shares, that’s $500 and $3,000, respectively. Either way, it’s cheaper than buying even one Bitcoin or 100 shares of the ETF, which would run you $6,200 at current prices.

Options generally represent bargain pricing on the stocks they represent, but LEAPS on the Bitcoin Trust ETF represent one of the greatest bargains I’ve ever seen in the market: control over one of the hottest assets in the world for less than 1% of the face value of that asset. This gives you access to all the gains Bitcoin is poised to make in the coming years with much, much less risk.

If Bitcoin hits $500,000 during Trump’s term, as predicted, that multiplied by the 3X return from the “Bitcoin Backdoor Trade” spells a potential 15X opportunity.

This sounds like a no-brainer to me…

Action to Take: This is a two-part trade. The first part is to buy a half position (half the amount of money you would normally invest) in the iShares Bitcoin Trust ETF (Nasdaq: IBIT) December 17, 2027, $100 calls (IBIT DEC 17, 2027, $100C) at current prices. Then, if Bitcoin corrects, as it does with some regularity, we will buy the second half. I will inform you in Catalyst Cash-Outs Live when you should buy the second half, but it will likely be on a pullback of 30% or more from current levels.

Position size carefully, as any trade using options should be considered speculative and, in this case, we are betting on a big move in Bitcoin over the next two to three years. This option gives us almost three years of time.